Share This

Related Posts

Tags

Cheaper to Buy?

By Erica Rascón on Jun 4, 2018 in News

In several metropolitan statistical areas (MSAs), owning a home may cost less than renting. There are se veral factors that determine home affordability when compared to renting, so let’s dive right in.

veral factors that determine home affordability when compared to renting, so let’s dive right in.

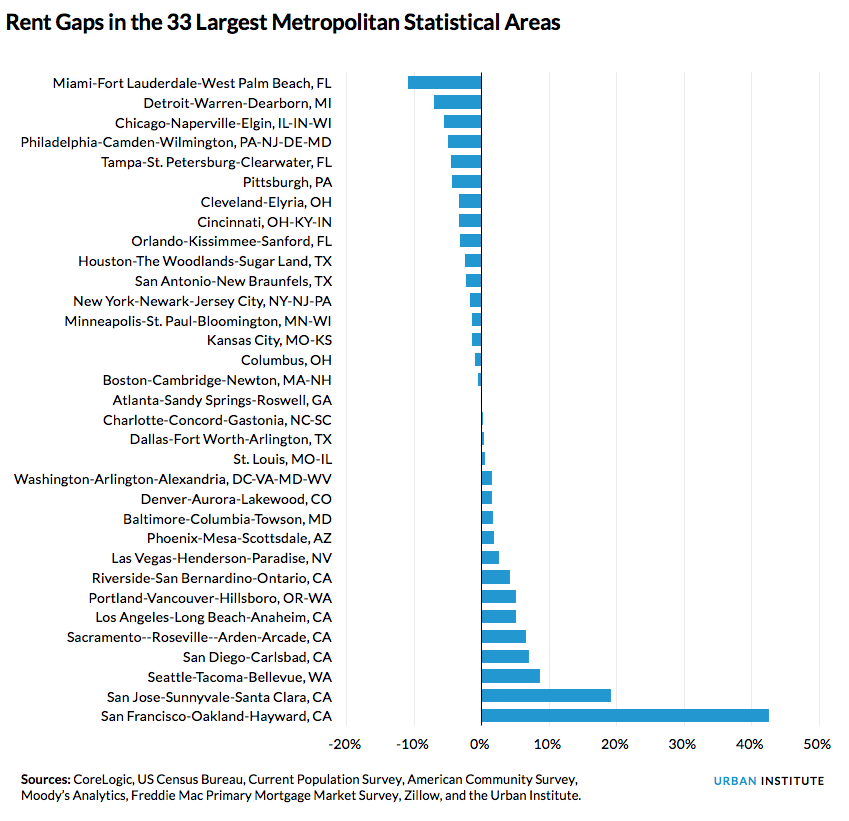

Out of the 33 largest MSAs, 17 have homeownership options that are more affordable than renting. Homebuyers’ savings could exceed 3 percent of their incomes in nine of the 17 cities.

Buying is more affordable than renting when homebuyers are able to:

- Put 3.5 percent down on the property, often with help of down payment assistance programs.

- Meet eligibility requirements for those down payment assistance programs

- Qualify for a loan for a median-priced (or less expensive) home

- Cover mortgage insurance costs, which vary by loan

Down payment assistance programs are a huge factor in home affordability. A report by Urban Wire helps consumers identify available programs by state. There are 2,144 down payment assistance programs from which borrowers can choose.

Top 5 Locations

Below are the top 5 cities where buying a home offers greater savings than renting.

Miami In this multicultural city of sun and surf, the buyer of a median-priced home could save about 11 percent of their income when compared to renting. This is even when the expense of Miami real estate is factored in: Miami is the 11th most expensive city amongst the MSAs in terms of mortgage affordability. The median mortgage costs 32 percent of buyers’ median income, which is 2 percent above the recommended affordability average.

While that mortgage-to-income ratio is high, it’s not as high as renting. Rent can cost a whopping 42 percent of a household’s median income.

Detroit As the Motor City continues to redefine itself, it entices residents with affordable housing stock. With a rent gap of -7.11, rent will cost 21.30 percent of applicant’s income compared to homeownership at only 14.29 percent. As for March, the median home value in Detroit was $26,003.

Chicago The rent gap in the Windy City comes in at about -6 percent. Renters will spend nearly 27.5 percent of their income on rent. Homebuyers, on the other hand, will only spend about 21.79 percent on their income on their house.

What’s more encouraging is that 43 percent of Chicago applicants met qualifications for down payment assistance. Borrowers received an average assistance of $5,647.

Philadelphia House hunters and renters alike have their fair share of housing options in Philadelphia, ranging from historic to modern architecture. Only one group, however, will feel the love of a rent gap of nearly -5 percent. Borrowers can expect to spend about 16.45 percent of their income on a mortgage while buyers will shell out more than 21 percent of their hard-earned money on rent.

Tampa When borrowing for a home around the median value of $208,132, buyers can expect to spend roughly 23 percent of their income on housing. Conversely, renters will spend nearly 28 percent of their income on a home in Cigar City.

Explore the remaining 17 cities where it is more affordable to buy than rent in the chart below.