Share This

Related Posts

Tags

Generation Rent

By Yardi Blog Staff on Aug 14, 2014 in News

The apartment industry has played a major part in the revitalization of the real estate sector while also significantly contributing to the American economy.

Rental market activity has grown at a moderate yet constant pace in most metros around the country, with up to seven million new renter households forming the last decade—almost half of all new households, according to data from the National Apartment Association (NAA) and the National Multi Housing Council (NMHC).

The post-recession slowdown in construction has translated into a tight housing market with low inventory levels and climbing rental rates. Corroborated with the massive influx of new renters entering the market, the multi-family sector is poised for more growth in 2014. It would take approximately 300,000 to 400,000 new apartments each year to meet current demand, yet just 158,000 apartments were delivered in 2012.

Tech-savvy young professionals generally identified as members of the Gen Y cohort have long been considered the most influential renter demographic for the apartment sector. However, a new type of renter has recently showed up on the real estate radar, which may well reshape the residential market in the coming years. Several industry leaders seem to think that baby boomers could become a key renter demographic in the coming years as empty nesters move out of the houses where they raised families and downsize into cozier, more sustainable apartment units.

A Research Notes recently published by the National Multi Housing Council aims to provide some perspective on the issue by analyzing the effect of two key demographic trends: the increasing population and the changing age distribution of that population.

NMHC reviews several aspects impacting the nation’s housing choices including demographic, economic and lifestyle trends.

Demographics influencing demand. A simple look at census data shows the population grew at a faster rate in the older ages than in the younger ages in the last decade. The large growth in this age group is primarily related to the aging of the baby boom population, with baby boomers (people born from mid-1946 to 1964) remaining one of the largest generations in U.S. history.

During the Great Depression, the number of births declined, falling to just 2.3 million in 1933. The postwar baby boom peaked at 4.3 million in 1957, while the succeeding “baby bust” bottomed out in 1973 at 3.1 million. Considering that the number of births has varied much less in the past 25 years than it has in the prior 50 years, and it pretty much stabilized at around 4 million a year, it is safe to assume that the number of young people entering the housing market should vary little over the next 20 years.

Taking into account the number of live births as well as death rates and likely immigrants, the Census Bureau expects the number of people 18-34 years of age to rise by 2.6 million in the next decade.

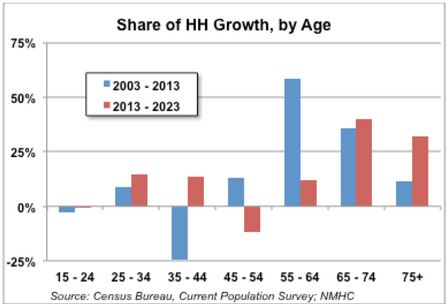

Projected household growth. By comparing two periods – 2003-2013 and 2013-2023 – NMHC was able draw some important conclusions that may help industry leaders better configure future development plans.

The number of households increased by 11.2 million between 2003 and 2013; more than half (58 percent) of that increase came among householders from 55-64 years of age. Over the next 10 years, however, that age group will make up only 12 percent of the increase in households. The greater part (72 percent) of the increase in households from 2013-2023 will occur instead among householders in the two oldest groups combined (65-74 and over 75 years of age), the NMHC research note says. The share of household growth among the youngest two age groups (15-24 and 25-34 years of age) will be slightly higher in the next 10 years than in the previous decade, but both shares will remain relatively small. (Chart 1)

The number of households increased by 11.2 million between 2003 and 2013; more than half (58 percent) of that increase came among householders from 55-64 years of age. Over the next 10 years, however, that age group will make up only 12 percent of the increase in households. The greater part (72 percent) of the increase in households from 2013-2023 will occur instead among householders in the two oldest groups combined (65-74 and over 75 years of age), the NMHC research note says. The share of household growth among the youngest two age groups (15-24 and 25-34 years of age) will be slightly higher in the next 10 years than in the previous decade, but both shares will remain relatively small. (Chart 1)

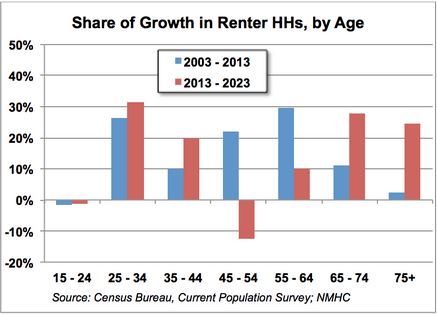

Things are quite different though when it comes to reviewing the evolution of renter households. The NMHC report reveals that over the past 10 years, just over half the increase came in the 45-54 and 55-64 age groups, while the 25-34 cohort made up an additional 26 percent of the 7.6 million increase in renters. The older two demographic groups made up only 13 percent of the total increase.

Based on the rentership rates reported by The Census Bureau’s 2013 Current Population Survey (CPS), the 25-34 age group is expected to make up 31 percent of the renter increase going forward, the largest of any single age group. However, the 65-74 and over 75 groups will make up a combined 52 percent of the growth in renter households. By contrast, the growth in renter households in the 55-64 age group will be slightly more than offset by the decline in renters in the 45-54 age group between 2013 and 2023. (Chart2)

Whereas young people will remain a key segment of the renter demographic, the baby boom generation might be responsible for adding more vigor to the residential market in the next decade.