By Katrina McDowell on April 19, 2024 in News

As real estate investors, putting in the work is required for the most significant ROI. Real estate investing can be a one-and-done deal or a strategy with more work but higher profits. However, using the BRRRR method, recover as much capital as possible from a project. Let’s delve into the BRRRR method and how to use it to negotiate deals, scale up your real estate portfolio and build a team for success.

The BRRRR Method. Buy, rehab, rent, refinance, repeat—the acronym for the smart investor’s investment cycle and should be repeated in that order. This method works best for those who have a good understanding of the rental market in their area as well as rehab costs. Getting good at this method takes some time and has a learning curve. Still, once done correctly, the BRRRR method is a sustainable way to buy properties quickly, generate passive income and begin that generational wealth. Here’s what to know:

- Buy. Purchase an undervalued property. Use short-term financing that can help get the funds quickly to make renovations. Aim for a 70-75% rule as a rule of thumb. Never pay more than that percentage of the estimated after-repair value. The 30% cushion helps offset repair costs while giving sufficient equity to qualify for a refinance.

- Rehab. Rehabilitate the property with repairs and improvements as seen fit.

- Rent. Rent out the property to a qualified resident and earn rental income. Use a good insurance policy like ResidentShield to protect you and your residents from damages.

- Refinance. Refinance will be used to cash out on the equity appreciation. Keep in mind that it is not uncommon for lenders to have a six-month waiting period from when the property was acquired before refinancing is allowed.

- Repeat. Repeat and buy another undervalued property. Be patient to avoid chasing bad deals.

After establishing the BRRRR Method, be effective with negotiation techniques. Have strategies for securing favorable purchase prices, navigating seller motivations and leveraging potential concessions.

Optimize long-term success using the BRRRR method when managing multiple properties. Investors can use proceeds from one project to fund subsequent ventures, creating a self-sustaining growth cycle. Owning a single property is all it takes to start the BRRRR method. Once equity is earned in that property, use it to purchase another property, but this time, it is an undervalued property to renovate.

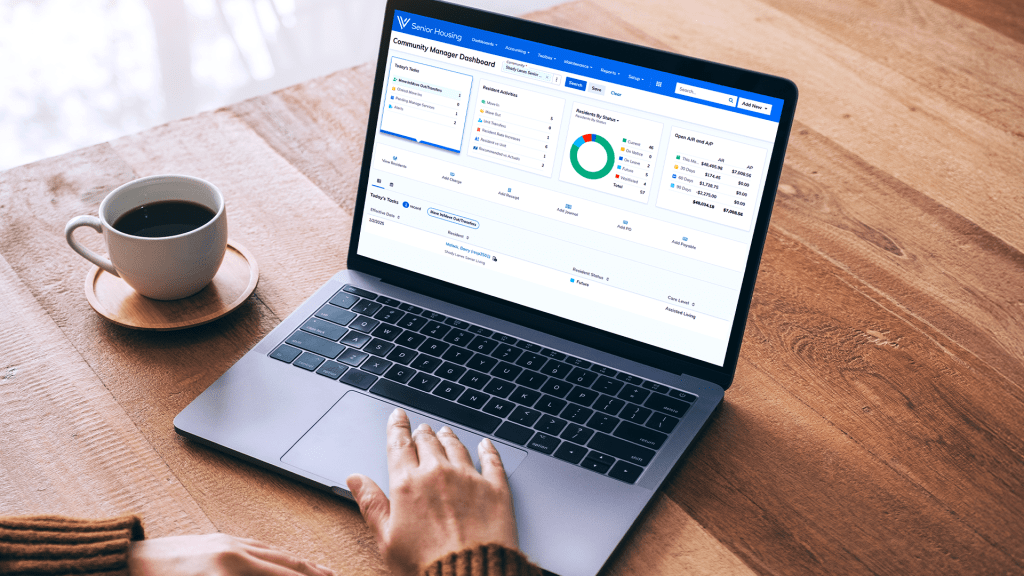

Remember that rehab will increase the property value, increasing your net worth and potential future profits when you sell the property. It also opens more opportunities to continue the BRRRR method by leveraging the equity in the recently renovated property to purchase another property and further grow your real estate portfolio. Implement good property management software once multiple properties are added to the portfolio. This is where Yardi products thrive!

Having a dream team is critical to any dream. Examine the significant roles of a BRRRR investment team, from real estate agents and contractors to property managers and lenders. Assemble a reliable team, foster communication and ensure each member contributes to the overall success of the BRRRR project. Keep up with reviews and surveys because you are only as good as your worst-performing property.

Ultimately, the BRRRR method works and begins a wealth and inert income cycle while growing the overall real estate portfolio without excessive capital. It is an excellent option for beginning and experienced investors.