Share This

Related Posts

Tags

Wall of Capital

By Paul Fiorilla on Feb 22, 2016 in News

Commercial real estate has seen a remarkable run-up in values in recent years, driven by steady job growth and robust fundamentals. The strong performance coincides with the economic recovery in the U.S., but even so, the outsized increases are well more than would normally be expected given moderate GDP growth in the 2% range dur ing that time.

ing that time.

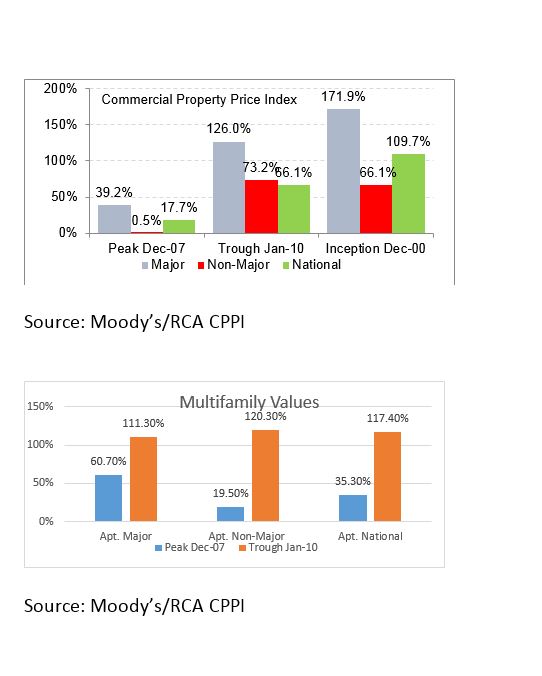

Overall, property values in the U.S. are up 17.7% from the last peak in December 2007 and 66.1% above the trough in January 2010, according to the Moody’s/Real Capital Analytics Commercial Property Price Index (CPPI). Major markets and apartments are doing even better. RCA’s core six markets (New York, Boston, Washington DC, Los Angeles, Chicago and San Francisco) are 39.2% above the last peak and 126% above the last trough, according to the CPPI. Meanwhile, apartments are 60.7% above the 2007 peak and 111.3% above the 2010 trough.

So what is driving the rate of increase? Simply put, there is a lot more capital looking to buy commercial properties than owners that want to sell. Commercial real estate is increasingly popular with a wide range of institutional investors, for a number of reasons. As noted, the sector has performed extremely well, which always drives capital, but it is more than that.

Commercial real estate produces a regular dividend that is very attractive. The average yield for core real estate is roughly 5.5% and for public REITs it is about 4%. Compared to other fixed-income products (say sovereign debt) that is extremely attractive, not to mention that the debt is secured by properties. Another attraction for foreign investors is to hold assets in American dollars. Whether Americans are satisfied with the level of growth in the economy, compared to other parts of the world the U.S. is seen as a beacon of stability.

What’s more, investors are largely bullish about the future of U.S. commercial real estate. The last downturn created a steep drop in construction, so compared to previous recoveries, the level of excess space that had to be absorbed was relatively small. The multifamily market is a good example. After several years of historically low levels of development, vacancy rates are at all-time lows in many markets. Development is rising, but demand is likely to remain high for several more years.

With all these trends, it is no surprise that 2015 set a record for the amount of money going into opportunity funds, which are commingled funds that invest in commercial real estate. According to Preqin, some $76.1 billion was raised for opportunity funds in North America, topping the previous high of $72.5 billion in 2008. One interesting feature of the data is that the number of real estate funds raised in recent years has declined as the total volume has grown, a sign that the fund world is increasingly being driven by giant managers such as Blackstone, Apollo and Lone Star.

However, the data shows that the onslaught of capital is not through, as nearly 300 funds are being marketed with the sponsors attempting to raise just shy of $100 billion. Along with the increased allocations to the sector from pension funds, life companies, high net-worth family trusts and other private investors, it’s a sure sign that the market is not likely to see a drop-off in capital anytime soon.