Property Week and Yardi brought together a host of leading industry figures at The Office Group, The Shard In London to discuss what the property industry is doing to tackle the climate crisis. The panel: Neal Gemassmer, Vice president, international, Yardi Sam Carson, Director of sustainability innovation, Carbon Intelligence Janine Cole, Director of sustainability and community, Great Portland Estates Alex Green, Assistant director, British Property Federation Malcolm Hanna, Sustainability manager, real assets, LGIM Caroline Hill, Corporate affairs and sustainability director, Landsec David Partridge, Joint chief executive, Argent Related Steven Skinner, Chief executive, HB Reavis Liz Hamson, Editor, Property Week (chair) What is the industry doing to address the climate crisis? Has it woken up to the scale of the problem and started taking the right action, or is it still in the talking phase? Skinner: I ask the question in a slightly different way. Is the ambition the right ambition? Is the ambition big enough? I think we are slowly moving away from an accreditation-based approach to sustainability, but is that happening quickly enough? Is that going far enough? What key areas should the property industry focus on? Hill: I think you have to start from the fundamental facts and listen to the science. The built environment is responsible for nearly 40% of global carbon emissions and that is a fact. So we, as the property industry, have an enormous role to play in tackling climate change – it is drilling down into your particular business and looking at what can you do. At Landsec, our focus is on carbon reduction and energy reduction. Setting really bold and ambitious targets and making progress each year towards them. But each agent in the property industry – architects, designers, engineers, developers – have all got a different role to play. It is about finding your space and then going for it. Partridge: We have to constantly look at innovation and think how much can I do. So even back in the mid-2000s when we got planning permission for King’s Cross, we committed to being 20% better than building regulations. So we built in a central energy centre that provides heating, cooling and electricity. There is no boiler in any of the buildings – it is all provided centrally. Off the back of that we have been able to get BREEAM ‘outstanding’ ratings for every single one of our office buildings. Someone told me the other day that 10% of all the BREEAM ‘outstanding’ buildings [in the UK?] are at King’s Cross. I did not even know it because you sort of see it as part of what you do anyway. How big a problem is embodied carbon for the industry? Hill: When we started with our new sustainability strategy five years ago, one of the first things we did was a full carbon-footprinting exercise with the Carbon Trust looking at the whole range of activities that Landsec does. And what that told us is that our scope three is the absolute lion’s share of our footprint. So for us, that is how we build our buildings through our supply chain with our contractors, and then there is the energy-in-use of our occupiers. And so our programme has for years focused on embodied carbon because we know that is where our biggest footprint is. Hanna: The other thing to remember about embodied carbon is if you think about the operational carbon that will be emitted over the lifetime of the building, which could be anything from 10 to 50 years, the embodied carbon is right up front. In terms of our approach, L&G has had targets in place for quite a few years and we recently achieved our previous 10-year target. So we are in the process of updating our science-based targets for the next 10 years. What does the industry need to do to address the embodied carbon...

Let’s Save the World...

Energy Reimagined Before 2050

The recently released UN Intergovernmental Panel on Climate Change report shocked everyone who was paying attention. In short, attempting to mitigate temperature rises to 1.5 percent by 2050 (which already seemed impossible to most) is too little too late. The globe is on a trajectory to see temperatures rise more than 3 percent by that time. The resulting flooding, droughts and superstorms will be catastrophic. A drastic shift in energy sourcing and usage is necessary to limit economic and humanitarian costs. Fortunately, drastic doesn’t mean impossible. Microgrids and carbon dioxide recycling are two available solutions that can make substantial impact. Microgrids Microgrids enable centralized power generation, storage and delivery. They offer more efficient power transmission, reduce costs for consumers, and decrease the duration of blackouts which can save lives and protect economies. A microgrid can “cut air pollution from the electric utility sector as much as 30 percent by 2030, saving 34,000 deaths a year,” states Smart Energy Consumer Collaborative. The systems offer more immediate benefits as well. Hurricanes Florence and Michael, for example, resulted in nearly $100 billion in property damages. After factoring in electricity outages and stalled commerce, Accenture estimates that such storms can cost economies $150 billion per year. The implementation of microgrids would reduce the economic impact of natural disasters by quickly restoring power. Microgrids also facilitate the integration of renewable energy sources with flexible scalability. Local organizations do not need to wait on utility companies or governments to implement more sustainable practices. Solar panels, roof-mounted wind turbines, and other sustainable energy devices can be used as the primary energy source on individual projects. Several power companies are exploring the power, efficiency and reliability of microgrids. Edison International, Central Hudson Gas & Electric, Duke Energy, San Diego Gas & Electric are just...

Rising Concern

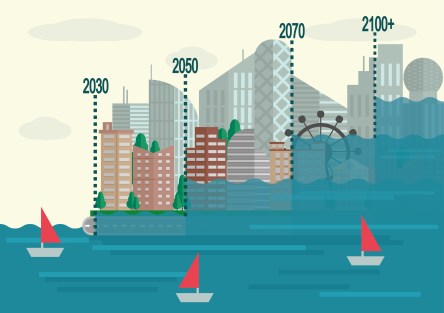

Sea Level Impact on Real Estate

Intense climate and weather-related events, such as hurricanes, hail and ice, heat and wind and inland flooding, are occurring around the world with alarming intensity. Three hurricanes in 2017 alone caused a combined $300 billion in damages. About 5 million people in the U.S. are within 4 feet of a local high-tide level. A United Nations report in 2016 noted that climate-related events could place real estate assets valued at $35 trillion at risk by 2070—about half of today’s global assets under management in any industry sector. By one estimate, a sea level rise of six feet would imperil U.S. coastal properties worth about $900 billion. How can real estate asset managers prepare for what could be an inevitable rise in sea levels and other manifestations of climate change? “Asset managers and investors already have access to energy efficiency data from providers like Yardi. Now they need project-level natural hazard data that includes climate change projections. This is something the climate resilience field is working on, with a variety of firm jockeying to be first with the rollout of their proprietary software,” says Joyce Coffee, president of Climate Resilience Consulting and a senior sustainability fellow at Arizona State University’s Global Institute of Sustainability. Some cities, such as Cedar Rapids, Iowa, are countering weather damage risk by building flood control systems. Other metros, like Philadelphia, Detroit and Washington, D.C., have increased sewage fees, spurring building owners to consider adopting more stringent water conservation efforts. Many other officials and private citizens, of course, focus their efforts on identifying and mitigating sources of climate change. Real estate investors, for their part, are incorporating climate risk into their analysis and avoiding risky investments. A whitepaper released by BlackRock in 2016 noted, “Investors can no longer ignore climate change....