The boom in high-rise construction signals a new era of success in multi-family housing. Critics, however, believe that the influx of luxury towers could lead to cities plagued by costly giants. The rise in land prices serves as a catalyst in the vertical construction trend. Reports by Zelman and Associates and The Federal Reserve Bank of Chicago indicate that US land values increased between 13 and 15 percent in 2012. Steep prices for small metropolitan plots have reminded builders that they are better able to accommodate the increased demand in housing by building up rather than out—and the skies offer fewer limits and greater possibilities for returns. New high-rises are earning their keep in the market. There has been a surge in ultra-luxury housing to accommodate affluent and enterprising consumers who seek stellar views in coveted locations. Foreign investors have invested en masse in multifamily towers. Their funds reach beyond major markets into secondary markets such as Houston, Seattle, Phoenix and Hawaii. While consumer interest and land prices undoubtedly fuel the increase in high-rise production, other market conditions prove favorable to the trend. The Bureau of Labor Statistics (BLS) indicates that the price of steel continues to decline. Steel mill product prices are down 9.5 percent since May 2012. Steel structural shapes saw a 7.1 percent decrease since May 2012. In contrast, the cost of lumber has risen in the past year. Many mills and plants were operating at a third of their capacity during the housing slump; manufacturers were not prepared for the invigorating jolt that the real estate industry received this year. Prices catapulted. The National Association of Home Builders notes that lumber prices have steadily risen, seeing only a minor dip in recent months. With the price decreases of April and May taken into consideration, framing lumber prices are still 16.7 percent higher than they were in May 2012 and 14.4 percent higher than in May 2010. In some cases, the decrease in steel prices and the increase in lumber costs bring the two materials within a 5 percent differential. Combined with the rising cost of land, building up is the smartest way to go. Mark Humphreys, CEO of Humphreys & Partners Architects, explained in a recent industry article: “Let’s say you have a property on an urban infill site that costs $100 per square foot of land. Wood may cost 10 percent less than its counterpart materials, but by doing a high-rise on the site, you get double the density and the land cost is cut in half. An acre of land with a 140-unit podium structure (with land priced at $125 per square foot) would yield a land cost of about $40,000 per unit. If you took that same land and put a 300-unit high-rise on top of it, the price would be just over $18,000 per unit.” It is a conclusion that firms across the nation have reached, resulting in proposed structures that would forever alter familiar skylines. West Philadelphia is experiencing a new wave of high-rise construction with seven projects in queue. Three of Texas’ cities top the charts for construction growth. Among them is Houston, which will see the construction of the $72 million Anderson Pavilion and the $45 million Hanover Post Oak rentals. New York City is also on the list despite its affordable housing crisis. The city cites over $20.5 billion in new construction projects in 2012, including the infamous Hudson Yards mixed-use development that will set Related Companies back $15 billion. Hudson Yards will include ultra-luxury high-rises. Even the student housing sector has witnessed an increase in sky-high construction. Experts and residents receive the high-rise boom with mixed sentiments. The skylines of major cities are revered as national icons. Changing those skylines changes a nostalgic piece of local identity that will not be surrendered without a fight. But the resistance goes beyond nostalgia. Critics believe that the quantity...

Amenity Arms Race

What renters want

Los Angeles—Gen Y likes rooftop pools, multimedia-equipped fitness suites, concierge package service and the ability to order housekeeping for their apartment. They have dogs, get lots of UPS deliveries but almost no mail, like walking places (but also need to charge their electric vehicles), and want the lobby of their apartment community it look like that of a four-star hotel. Sound high maintenance? It’s a fair assessment. Last week, a panel of multifamily experts delivered an overview of “What Renters Want: Development + Design Trends that Drive Occupancy,” at an AIA continuing education event held in Los Angeles and sponsored by Multi-Housing News, Interface and Universal Fibers. Speakers Manny Gonzalez, principal, KTGY Group; Kelly Farrell, vice president, RTKL; and Alan Dibartolomeo, chief development officer, AMF Development Inc. didn’t pull any punches when it came to the wish list of the nation’s largest renter demographic: 20-to-mid-30-somethings. “Gen Y rents by choice. We’ll see if they continue to rent by choice as they age. But if they keep renting, your rentals will have to be flexible enough in their amenities program to meet their needs in the future and the needs of their kids,” said Farrell, who described the demand for services among today’s typical resident. They want to be able to order up housekeeping, but not pay for it on a regular schedule, calling for an appointment when they have been too busy to clean or Mom and Dad are coming to visit. Someone should be in the lobby to receive their dry cleaning delivery and accept their packages while they work. Rent should be payable by credit card so they can auto-schedule the payment and forget about it. The good news is that they’re willing to pay for these conveniences. “It’s a generation that...

Food Truck Fun

Lure prospects with good eats

Looking for a new way to bring prospective residents to your property? One innovative approach, tried out successfully at numerous communities, involves everybody’s favorite meals on wheels: Food trucks! At a largely student-populated apartment complex in Gainesville, Florida, bringing together 12 food trucks for an afternoon this April resulted in resident fun, great local media buzz, and a handful of new leases. Stoneridge Apartments’ Super Sunday Funday Food Truck Festival wasn’t just a success – it was an epic success. “We had a turnout of approximately 500 people and our residents loved it. We’ve had a lot of positive feedback as well as requests for more food events like these,” said Denise Snyder, Regional Property Manager, CAM, for The Emmer Group. “The food ranged from awesome cupcakes, to ice cream and doggie ice cream, and there was Thai food, Cajun food and gourmet grilled cheese.” Snyder had a strong feeling that food trucks would go over well with her residents, and not just because many of them are college students who love to try new things. Stoneridge’s popular Perks Program, which gives residents discounts at local restaurants and other businesses, has been a big success. “Our residents (and staff) love to eat! We plan to host another big event this fall, and delectable treats will certainly be a huge draw,” she said. Harnessing the power of social media before, during and after the event, word-of-mouth from residents and local businesses drove prospects, friends of residents, and the simply hungry to Stoneridge. Once they’d wandered the truck lineup and sampled some tasty treats, there was no reason to leave – a beer garden was set up on site, next to a lake on the property and under some shade trees. There was live music and...

Alexis Vance

Alliance Residential

Alexis Vance wants to get inside the minds of the Millennials. So the vice president of marketing for Yardi client Alliance Residential Co. and her team completed an in-depth demographic analysis that revealed not just facts, but helpful nuance, about the country’s newest powerful renting and spending cohort. With a nationwide portfolio that touches 24 major metro markets, Vance knows that going beyond the surface to understand Millennials, who seem to appear in every other news story on demographics these days. While there is some definitional discrepancy about the exact range of the Millennials’ birth years, they are essentially in their early 20s to mid-30s today. Many moved back in with their parents during or after college due to a tough job market, but as the economy has improved, they are expected to account for formation of up to 3 million new households. They’re an important new consumer base for apartment owners and managers, and some of their unique behavior patterns—including reliance on technology and social media to accomplish almost any task—have made them the subject of focused marketing studies like Vance’s. “I do believe our industry needs to do its homework to truly understand this complex demographic. We need to shift marketing and communication habits significantly in order to effectively market to and resonate with this highly media-savvy generation,” Vance said. MHN: Could you define: experiential marketing, social responsibility and incentive to share as they are relevant to the multifamily leasing and living experience? Vance: Experiential marketing goes beyond a basic tagline, brand or event. The effort is comprehensive and engages the prospect in a way that allows them to participate with the brand. Because this demographic is skeptical of traditional advertising channels, experiential marketing is an excellent way to create conversation and develop rapport through...

Gone to the Dogs

Chicago's On-Site Dog Spa

Pet-friendly buildings are currently the cat’s meow (or the dog’s wagging tail, as it were)—and this trend doesn’t seem to be waning any time soon. And many property managers are going beyond being just pet friendly, and are offering amenities for the pets themselves. First came the dog runs. Then came the pet washing stations. Some communities even offer doggie day care and spa features for Fido. And residents are lapping it up! In Chicago, Related Midwest’s new community 500 Lake Shore Drive is offering something special for residents who are pet owners. The company is offering an on-site pet service called Dog City, which offers a variety of services for these pampered pooches, such as dog walking, pet sitting, grooming, nutritional counseling, delivery of custom pet meals, vet visits and training services. There’s even a service for “paw-dicures.” And dogs aren’t the only ones who can get in on the action—the “paw-dicure” service is also available for cats. These services makes it easier for residents who might work long hours or who are going away and don’t have anyone to take care of their dogs in their absence. Several of the services offered are at an additional fee, but there are also some “self service” areas of Dog City where residents can use the pet grooming equipment and towel services. Sounds like the purr-fect amenity for pet lovers. Jessica Fiur is News Editor at Multi-Housing News. Find more of her insights on multifamily living on the “What Renters Want”...

Jeff Elowe

Laramar Group

Last month, The Laramar Group announced a major acquisition in Southern California. With the purchase of Los Angeles-based JB Partners Group, the company assumed management of 7,000 new third-party owned units, adding 77 properties and 170 employees with the merger. It’s the latest significant uptick in what has been a steady several years of national growth in inventory for the Chicago-based firm. CEO Jeff Elowe, who was recently named Entrepreneur of the Year by Ernst & Young for the Mountain Desert Region, took the time to speak about the company’s strategy and give us his take on the multifamily industry now. Elowe has worked in multifamily since 1989, and has charted the course for Yardi client Laramar as the firm invested $3 billion in real estate, primarily multifamily and retail assets. MHN: The Laramar Group came out of the economic downturn in a strong position as a third-party manager and owner. How has the last year been? Are you still seeing growth, and in what asset sectors and markets specifically? Elowe: We used the downturn as an opportunity to grow, especially our third-party management business. We grew by two and half times. We really took on a lot of meaty assignments that led to a more institutional third-party management business. We’re in 26 markets, so we expanded from about 15 to 26 markets, with a distinct focus on major market, such as Los Angeles, where we now manage in excess of 8,000 units. It’s a very big target market for us, and we acquired a property management firm there. We really grew on a national basis and established Laramar as a highly recognized, go-to property manager for institutions, lenders, and servicers. MHN: Denver has been an especially strong multifamily market as of late, and...

Multifamily Focus

Rental demand is strong

Homeownership across the U.S. continued to decline 40 basis points in the second quarter of 2013, creating a favorable context for multifamily to thrive. Rental demand remains strong with occupancy gains and rent growth occurring in every major metro around the country. Annual rent growth across the U.S. is currently averaging 3.4 percent, according to research data from Jones Lang LaSalle. Driven by an improving job market as well as significant population growth recorded within two key renter demographics (eco-boomers and empty nesters), both multifamily occupancy and rents have climbed well above their 10-year averages, JLL research shows. Richmond, Portland, Nashville, Dallas-Ft. Worth and the Inland Empire have seen the largest increase in rentership over the last 12 months with more than 4.0 percent of households migrating away from home-ownership. All signs seem to point out to a rebounding rental market, yet the road to successful renting is not always smooth. Ensuring an uninterrupted cash flow falls almost entirely on property managers and their ability to retain quality tenants. A recent report from J Turner Research, a leading marketing research firm exclusively serving the multifamily industry, reveals that three out of top five complaints are directly related to customer service as delivered by the on-site management teams and maintenance technicians. The top 10 multifamily apartment resident complaints resulted from J Turner’s survey are: Rental rates Poor grounds / common area upkeep Disorganized staff / lack of communication with staff Quality of response to maintenance requests Overall customer service of management staff Quality of parking / parking availability Concerns over security / safety / lighting Lack of upgraded amenities Pets not on leash / poor pet waste removal General lack of preventative maintenance The report was based on the analysis of 10,000 customer satisfaction...

Modern Company Town

Facebook builds apartments

Facebook employees in California are about to find out what it means to reside in a modern version of the historic “company town”. The social media giant is working with Yardi client St. Anton Partners, a local multi-family development and investment company, to develop an upscale multi-housing complex within walking distance of Facebook’s existing Menlo Park headquarters and their new West Campus, which is currently under construction. Designed by national architecture firm KTGY Group, Inc., the multifamily compound was envisioned as a cohesive live/work/play environment where practical design meets style and comfort. Dubbed Anton Menlo, the infill redevelopment project represents the Menlo Park City’s first significant new apartment building in over 20 years. “At over 630,000 sq. ft., this project is one of the largest new construction rental residential projects in the state. We’re pleased to bring it to where housing is needed most,” noted Peter Geremia, co-founder of St. Anton Partners, in a written statement. The site recently received its final zoning approval from the City Council and is currently in the design review phase with City staff, according to official statements. “We are thrilled to have new housing options coming to the City of Menlo Park to serve the Silicon Valley and the Marsh Road and Willow Road business areas,” said City of Menlo Park Mayor Peter Ohtaki. “Providing new housing opportunities for employees working in the area will allow people to live where they work and to spend more time enjoying this great city.” To be located on a piece of formerly industrial land, a 10-acre tract near Marsh Road off of Highway 101, the $120 million community will comprise 394 apartment homes primarily designed to meet the needs of today’s sophisticated renters. It will offer a mix of floor plans...

A Rising Star

Pettit Recognized by MFE

Billy Pettit, senior vice president of Seattle’s Pillar Properties, has been named 2013 Rising Star of the Year by a major multi-family trade publication, Multifamily Executive. Pettit’s aggressive rebranding of Pillar’s marketing strategy and strong leadership of the company, a division of R.D. Merrill Co., helped earn him the award. A passionate and creative visionary who was recruited to join the company by his father, President Bill Pettit, he embraces a hands-on approach to development and technology and is eager to try new things. Back in December, Pettit gave us great insight into his approach and willingness to try out new technologies in an exclusive interview. Here is an excerpt: Pillar’s five apartment communities implemented Yardi Voyager earlier this year, as well as mobile applications for inspections, maintenance, invoice approval and resident services. Yardi Leasing Pad allows on-site leasing agents to be able to sign prospects anytime, anywhere. Pillar leasing staff members tested Leasing Pad at two properties. One, The Lyric on Capitol Hill, is a brand new community undergoing the lease-up process. “Our mobile vision is empowering our team members so that they don’t have to sit behind a desk any longer. They can take care of just about anything they need to do at any location throughout our buildings, whether it’s the leasing staff, the maintenance staff, or me as a manager,” Pettit explained. In practice, Leasing Pad meant that with an iPad as the only necessary tool, agents could execute a lease in the apartment unit the prospect selected, on the rooftop deck with beautiful views of the Seattle skyline and Mt. Rainier, or even down the street. “They were beyond excited about the ability to meet with the prospect at a local coffee shop, or meet with...

Preparing for Postal Reform...

May affect multi-family mail

The House of Representatives will soon vote on a bill that may centralize mail deliveries at apartment buildings and alter delivery schedules. We’ve all seen the change taking place. The postal service became known as “snail mail” the moment that email reached most American households. Online bill pay let us settle balances with the click of a mouse rather than the lick of a stamp–or by gingerly tapping our mobile touchscreens. During travels, we began posting pictures and status updates via social media rather than sending postcards. Many of us can’t think of the last time we entered a USPS. The FedEx and UPS locations seemed to be much more convenient and efficient. When we sit back and think about it, few of us are really surprised that the United States Postal Service is in a crunch. Americans simply don’t use the mail system like we used to. In order to stay afloat, Congress deliberated multiple times to determine the future of USPS. Major changes will be made, many of which affect multi-family firms and their tenants. Regular mail delivery could be shortened to five days per week or fewer, though Saturday deliveries will remain protected for at least one year after the enactment of the bill, if it passes. Approximately 125 post offices will eventually close, though the bill has provided a lifeline to an equal quantity of processing centers that were heading to the guillotine to cut costs. For multi-family firms and renters, though, one change holds the greatest impact: the new plan aims to create centralized delivery services particularly for apartment communities. This may create challenges for leasing offices and added inconveniences for renters. Hurdles for pre-existing leasing offices: Storage Leasing offices would need to prepare a designated, secure location to...

Healthy Luxury Living

Related Companies

For those familiar with the industry, Yardi client Related calls to mind images of grandeur: a wildly successful company that constructs towers that tickle the clouds of America’s most desirable cities. Related has come to embody the upper echelon of commercial and residential development. Without missing a beat, the company is also promoting health as a notable characteristic of the brand. Related’s nationwide, smoke-free housing policy turned heads this summer. The nation’s largest privately held real estate development firm raised the bar by converting every property in its portfolio into a clean air haven. The conversion, estimated for completion within a few years, is the first of its kind in the US. The development of the Hudson Yards megaproject adds another gem to the crown of Related’s healthy living plan. The site in the New West Side, as the neighborhood is being called, demonstrates grand scale gentrification of Manhattan’s water-front. Ultra-luxury goods and services will abound around the complex. Upscale shopping, world-class dining, and housing that offers breathtaking views of the city are only the basics of the project. Related’s sustainability efforts set this development apart from others of its kind. The towers will boast an energy efficient envelope for optimal climate control. Their ventilation design promotes natural air circulation. Hybrid heat pumps and fan coils offer cost-effective heating and cooling systems that put less stress on the power grid than their traditional counterparts. Interior spaces that cater to natural sunlight will boost the moods of residents while on-site power ensures that occupants can enjoy business as usual even in the midst of natural disasters. Energy efficient fixtures, appliances, and finishes top off the design plans. Related strives to provide eco-friendly and health-conscious facilities without sacrificing comfort. For more on the residential smoking ban and the Hudson Yard’s development, see Healthy Amenities: How to Walk the ‘Green’...

LCOR

Expanding in Philadelphia

Though Philadelphia is a major city, on the whole, many apartment developers haven’t sought out to construct new buildings in the area. However, Yardi client LCOR, a real estate development, management and investment company, is looking to expand their pipeline in the area, which they consider to have unique attributes. “I think this is an important time in Philadelphia real estate. There’s a lot of activity, but it’s a market that has seen moderate but steady growth over the years,” Donald Tracy, vice president, LCOR, says. According to Tracy, a reason that the market in Philadelphia is growing is because the population of young professionals is growing. “So many of the college students that come here for their education stay here,” he says. “There’s an opportunity to provide quality housing for that group in an institutionally financed way that perhaps was a slow process in the past few years, but has grown over the last two years. There is a significant pipeline in the next few years that will continue to grow.” Though LCOR sees a lot of advantages in developing in Philadelphia, they are aware of some challenges. “I think there is somewhere in the neighborhood of 3,000 units in the pipeline to be delivered over the next several years, and while there’s fairly robust demand for that pipeline, you have to be careful to deliver the right product in extraordinary locations and create a product that meets demand,” Tracy says. “The other component of it is that when the economy gets better, the demographics get better and there’s more of a shift towards development in the region, I think there’s a fairly direct correlation in construction pricing. I think we need to continue to monitor that very closely to make sure the...

Designing Unique Apartments...

Tips from a noted pro

Just because the community isn’t student housing doesn’t mean you can’t have a little fun when you’re designing or staging the units. The Residences at W Hollywood, the residential branch of the W Hollywood Hotel, recently hired Christopher Grubb, president of Arch-Interiors Design Group, to design one of their penthouse units. Flat-screen televisions, a putting green and a Wii system later, Grubb unveiled a penthouse that has been dubbed the “grown-up playhouse.” Sure, for this exercise, Grubb might have left out components that you might want in your apartments—a bed, for example—but that doesn’t mean there aren’t important take aways from his whimsical style. “Don’t limit yourself in having fun in the space,” Grubb says. In addition to the pointers that Grubb gives for designing a unique space, Grubb also gave some tips and tricks for making an apartment look bigger when you’re staging it for potential renters. For instance, Grubb suggested using smaller furniture that won’t overwhelm the space, and having some multipurpose furniture. Additionally, consider having a Murphy bed. This way you can show off all the fun elements or entertainment features, but the potential residents will be able to imagine themselves going to sleep there. A final tip? Don’t be afraid of color. “A lot of people subscribe to [the thinking that] they need to keep it neutral and the ceiling white to make it seem bigger—but [then you have a space] that’s not unique,” Grubb says. “My whole career is to create a space that people will love.” Read the entire interview with Grubb here: http://www.multihousingnews.com/features/mhn-interview-design-tips-for-fun-apartments/1004087063.html Jessica Fiur is News Editor at Multi-Housing News. Find more of her insights on multifamily living on the “What Renters Want”...

Bike Sharing

Awesome apartment amenity

Bikes are extremely attractive to apartment renters who live in urban areas. After all, bikes are green, they don’t take up a lot of space and riding is great exercise. Plus they allow riders to avoid being stuck in city traffic jams, which alone makes up for the cost of the bike. Many apartments already provide bicycle storage areas for their residents, either included with the apartment, or for a small amenity fee. I want to ride my bicycle, I want to ride my bike. I want to ride my bicycle, Anywhere I like. —“Bicycle Race,” Queen And, with the popularity of bikes soaring, some communities are taking the bicycle amenity one step further with resident bike-sharing programs. Take, for example, Related Companies. Related, partnering with bike-sharing company Zagster, is going to start offering an on-site bike sharing program in its New York communities. Once residents join the program, they can send a text to reserve a bike (which will be located in their community’s garage or parking lot) for the whole day. The bike keys will all be conveniently located in lock boxes on-site. Bikes will all include large baskets, making them ideal for residents who need to run a few errands—perfect for city dwellers who might not have easy access to a car. A bike-sharing program will save residents money, as well as storage space in their apartments if their community doesn’t have a bicycle storage area. It also provides a great amenity that will actually be used. And it’s eco-friendly. Beyond a little helmet hair, a bike-sharing program could be a great amenity to attract new residents. Jessica Fiur is News Editor at Multi-Housing News. Find more of her insights on multifamily living on the “What Renters Want”...

Digital Marketing Trends

Strategies to boost social engagement

The rise of e-commerce has transformed the world into a global marketplace where the focus is on connectivity. Consumers have learned to navigate through the avalanche of sales and discount deals, and have come to value expertise, quality service and responsiveness more than anything else. More important than ever, digital marketing enables real estate companies to engage with their customers while they spend time online. Best practices for outreach and engagement are in a continually fluid state. Marketing trends in the digital era Among a series of marketing strategies aimed at drawing customers, organic search and cost per click (in both cases read Google) emerge as the most reliable sales channels on the online market today, according to a recent report from Custora. Not far behind, e-mail marketing and social media networks help get the message out. Even if sponsored stories on Facebook or Twitter don’t have an immediate impact, social media can help businesses enlarge their fan base, gain visibility and turn one-time buyers into loyal customers. Social media in multifamily can serve a number of purposes. From raising ambient awareness to promoting a brand or a community, online communication is key to a successful relationship with your residents. By addressing their concerns, getting involved in community matters and proactively responding to reasonable requests, you will be able to increase renter satisfaction and generate positive feedback. After all, the least expensive leasing transaction is the renewal. Keep in mind that social media channels were conceived as a means to connect people who share common interests. Your audience does not spend time on Facebook, Twitter or Pinterest to get spammed with sales messages and marketing pitches; for best results, marketing consultants recommend posting one promotional post for every nine posts that are not related to advertising. In other words, only 10 percent of your social content should be overtly promotional nature. This really is about branding, goodwill and reputation building. Measuring social media efforts Measuring the results from social media efforts can be a real challenge. While there are ways to keep a track of the number of likes, shares, tweets and retweets a page might get and link them later on to leads and leases, there may not be immediate financial return. A person liking your page does not mean he will automatically sign a lease, yet it will give great exposure to your property and you’ll be among the top options when the prospect looks for a new place. Think of social media as a platform that supports the other advertising efforts that you have in place. Kristie Bergey, the owner of KB Experience, an event planning firm and marketing agency for the apartment world, uses Facebook, Twitter, Pinterest and Instagram for communication. “It is a great way to get the word out about the property through the ad campaigns on Facebook but also to residents who can bring their friends to the property for an event,” Kristie said. “Or if they want to rent, the resident receives a referral fee.” Some companies, such as Core Campus, have an extensive presence on social media. One of their latest projects, the Hub on Campus, a $40 million student housing complex and one of the largest projects under development in Arizona, has created quite a buzz on all social media channels. With an opening planned for fall 2013, the property is almost full. Facebook contests, referral incentives and gift certificates were used to generate prospect interest and build buzz for the lease-up Further, the property Facebook page has become a way for residents and prospects to communicate with the property management staff. Effective tools to manage and monitor online reputation Search engines like Google and Yahoo! Bing provide direct pathways to you and your business so it is important to monitor the virtual environment on a regular basis. Consider setting up a Google Alerts account with the name of...

Walt Smith

Riverstone Residential

Dallas – Riverstone Residential is no stranger to the ranks of the nation’s largest multifamily management firms. With 174,838 units around the country, the last year and a half has been a period of steady growth for the privately-held company. As the largest 100 percent third-party apartment manager in the U.S., Riverstone’s recent growth is based on the development and expansion decisions of its clients. CEO Walt Smith took the time to tell us about what’s trending from the company’s point of view. MHN: It’s been a strong couple of years for the multifamily industry. How has Riverstone expanded as America experiences a renting renaissance? Smith: We’re focused on maximizing as many opportunities as possible, including working on strategies to appeal to members of Gen Y as they form new households, and finding ways to attract Boomer residents as they begin to downsize and realize the benefits of the flexible renter lifestyle. We’ve also dedicated more resources to analyzing local market data for the benefit of our clients. Retaining our current residents is incredibly important, and we’ve been identifying ways to expand our services so that we build value, convenience, and technological innovations to create memorable resident experiences. Finally, we’ve focused on implementing technological platforms to improve our company-wide efficiency and effectiveness as service providers. MHN: What have been the most notable aspects of Riverstone growth over the past 18 months? Smith: Although we’ve enjoyed substantial increases in our management contracts across diverse property types and markets nationwide, we’ve definitely observed some specific growth trends in the assets entrusted to our care over the past 18 months. We’ve seen a 60% increase in our management of high-rise assets as well as a 25% increase in lofts. We’ve experienced substantial growth in our Northeast region,...

Rental Art

Multifamily creativity

Your community’s curb appeal is key in enhancing asset value. Location and price are still at the top of the most coveted amenities among urban apartment renters, yet creating an attractive atmosphere and relaxed background is critical as well. A safe and comfortable community that features an inspired design will linger in the minds of prospects touring your property, and act as leverage when it comes to weighing housing options. When prospects are first introduced to a community, they are very interested in the general vibe of the place, the looks and feels of the community. Once they become residents, they expect the same level of service and responsiveness, transforming ambiance into a retention driver that will help you keep your residents happy. One way to ensure good design is by personalizing your properties with unique works of art. Whether it’s used to add aesthetic value to an office, recreational center, lobby, or living space, artwork can make a great difference in terms of visual appeal. Chosen with care, an intriguing painting can add edginess to a blunt room or transform a rigid setting into a welcoming place; it can make any area feel stylish, comfortable and complete. Acknowledging the need for more affordable and customizable art services, several entrepreneurs in the creative sector have come up with a solution in the form of rental art. Innovative companies such as HangItUp Chicago offer unique paintings, designs, photography and sculptures to individuals and businesses for rent or sale. Not only is rental art an economic option for those who seek to beautify and diversify spaces, it also allows businesses to rotate art pieces and alternate design schemes, keeping their professional environment ever-changing and exciting. In conjunction with interior decorations, artwork can be used strengthen your...

Credit Score Options

Honing in on new households

For multifamily property managers, flipping a coin to decide whether or not to rent to a prospect with thin or no credit information can hardly be considered an industry best practice. But with 27 to 30 million potential apartment renters who can’t be evaluated for a traditional credit score, usually due to lack of recent credit history or absence of any credit data at all, having some way to assess the “unscoreable population” is becoming increasingly important. As national economic recovery continues in the post-recession period, economists are talking a lot about the concept of “household formation.” It’s essentially the unbundling or decoupling of shared housing situations, which became increasingly common during the most recent lean years. Historically, 1.1 million new households are formed every year in the United States. Current figures are still lagging behind that average, with just 746,000 households formed in the last year. But as job growth continues and young renters are able to earn better wages, household formations are expected to pick up. “Things have improved, they’ve found a job or gotten a better job, and they’re ready go out and find an apartment of their own. But without recent credit history, in most resident screening models they will come back as unscoreable, basically a ghost. Then the landlord finds themselves making a qualitative decision to determine what they want to do with that person,” explained Patrick Hennessey, vice president of Resident Screening for Yardi. It’s a dilemma that could put property leasing agents and managers in a tough spot. But additional options for credit screening, including a new solution being offered by Yardi Resident Screening, can address this pain point head on. In addition to a tried and tested proprietary scoring formula, Resident Screening users now have the...

Going Smoke-Free

Benefits of an Apartment Ban

Banning smoking in apartments is often a controversial move that might be met with some resistance, especially if the building didn’t originally have this as a restriction. If residents are smokers, they might resent being told that they cannot smoke in their own homes. However, there are many benefits to banning smoking in a community. Beyond the health concerns—second-hand smoke can infiltrate other apartments—smoking increases the risk of fires. Additionally, property managers who put a non-smoking clause in the lease could often see a greater ROI on their units when they turn them over. When a resident smokes in the unit, the property manager must pay to get the smoke smell out, as well as pay to repaint walls discolored by smoke and to fix any damages caused by cigarette burns. Related Companies recently decided that not allowing smoking in their communities would greatly benefit both them and their residents. The real estate company announced that its national portfolio would be completely smoke free. For those residents who are smokers, once it’s time for their lease to be renewed, they must sign an amended copy signifying that they know they cannot smoke in their units. Of course, a smoke-free initiative at a community might be hard to enforce, especially if a smoker isn’t caught in the act. But having written warnings, fines, or even the threat of eviction in the lease agreement will seriously curtail smoking in the community. Though smokers might not be thrilled with the smoke-free clause, overall, Related has already received positive feedback from their initiative. Jessica Fiur is News Editor at Multi-Housing News. Find more of her insights on multifamily living on the “What Renters Want”...

Satisfied Renters

Approach ownership in slo-mo

In the aftermath of the Great Recession, the fluctuating economic climate along with a staggering housing market resulted in a shift in priorities for many Americans. Younger people don’t rush into home ownership as their parents used to, and continue to delay major life decisions like getting married and having kids. By the numbers, the share of Americans who own their homes was 65 percent in the first quarter of 2013, down 0.4 percentage points from the first quarter 2012 and the lowest level since the third quarter of 1995, according to the latest data from the U.S. Census Bureau. The ongoing decline in the home ownership echoes the rising demand for rental units and increasing investor interest in multifamily assets. Owner-occupied housing units made up 56.0 percent of total housing units, while renter-occupied units made up 30.2 percent of the inventory in the first quarter 2013. Vacant year-round units comprised 10.5 percent of total housing units, while 3.4 percent were for seasonal use. Fannie Mae’s Economic & Strategic Research Group recently released a new research study that investigates the impact of consumer attitudes toward renting and home ownership on the future of housing in America. As it turns out, Americans’ confidence in the recovery of the housing market climbed sharply in 2012, consistent with the trends that point out to a strengthening real estate sector. Becoming a homeowner is still an important milestone for many people, including the younger generation, though most renters are satisfied with their renting experience. The vast majority of renters think people are better off owning if they seek control, privacy, and security, want to raise a family or invest wisely, but they give the edge to renting when it comes to making the best decision in today’s economic...

Shrinking in Size

Real Estate Preferences

As the saying goes, location isn’t just the most important thing in residential real estate; it’s also the second and third most important, too. A recent report released by the Urban Land Institute (ULI), “America in 2013”, reveals a growing preference among young adults to live in urban environments and mixed-use communities with reliable, convenient transit service, in close proximity to jobs and entertainment destinations. Gen Y-ers preference for city living may come as no surprise yet the same trend may be noticed among Gen X-ers and Baby Boomers. As empty-nesters develop a taste for traveling, sustainable lifestyles and relaxed living, renting becomes a viable alternative to home ownership. Moreover, apartments in the cities offer great amenity packages that often times surpass the comfort that you could afford in a suburban single-family residence where you have to deal with maintenance, replacement, upkeep, wear and tear, and potential depreciation. Based on a nationwide survey of 1,202 adults conducted between January 16 and February 3, 2013, the report suggests that demand will continue to rise for infill residential development that is less car-dependent, while demand could wane for isolated development in outlying suburbs. In addition, data shows that people have come to value location and sustainability over unit size and proprietorship. Among all respondents, 61 percent said they would prefer a smaller home with a shorter commute over a larger home with longer commute. Fifty-three percent want to live close to shopping; 52 percent would prefer to live in mixed-income housing and 51 percent prefer access to public transportation. As the largest demographic group today, Gen Y or Millennials, who are also the most racially and ethnically diverse cohort, are expected to have the most profound impact on urban growth patterns and land use. Fifty-nine percent...

Greystar

Promoting growth from within

Greystar paved the way for an impressive finish to 2013 with multiple national awards. When National Multi Housing Councill unveiled its annual list of 50 Largest U.S. Apartment Managers, Yardi client Greystar emerged on top yet again. It received the same honor from Multifamily Housing Executive magazine. The company holds several years in the first place with both entities. Recent growth facilitates a promising 2014 as well. Greystar emerged as an unexpected victor in an arduous and complex acquisition. Greystar, along with partner Goldman Sachs, received a portion of a 27-property portfolio that includes over 2,000 units. It was part of a $1.5 billion dollar disposition; Equity Residential sold a total of $9 billion in assets to fund the purchase of Archstone. “Given the breadth of our organization and our presence in each of their markets, we were able to underwrite a significant number of assets and had the ability to perform due diligence quickly,” reports Greystar CEO Bob Faith. The additional properties will help Greystar stay among the nation’s largest managers. The company also has gained approval for a $50 million plan to revitalize the Linwood neighborhood in Fort Worth (rendering, above right). After purchasing 24 vacant duplexes, Greystar will raze the site and construct 22, three-story row houses, and four apartment buildings with a combined 352 units. If the deal closes in August as planned, the project will be ready for the public in January 2015. Though the company continues to grow, its members are dedicated to maintaining a community culture that is supportive and personable. This goal is accomplished in part by an engaged and compassionate staff of employees. Greystar received the 2012 National Resident Satisfaction Award issued by SatisFacts. The award is decided based upon customer satisfaction scores, lease renewal...

Micro-Size It!

How small is too small?

SAN DIEGO —Even in markets like New York and San Francisco, it may soon become prudent to ask: Can apartments be too small? In recent years, developers have begun experimenting with layout and design to determine just how tiny a space they can easily lease. During the Urban Land Institute’s 2013 Spring Meeting, Kauri Investments Ltd. chairman James Potter and AREA Real Estate LLC principal David Adelman offered some creative configuration ideas that are attracting Gen Y and empty-nesters alike. Either group may use such units as their sole residence or maintain a larger, perhaps weekend-only, additional home farther from the city. What makes these renters different from those who prefer more space, Potter noted, is their even greater focus on price point. Over the past four to five years, Potter has been striving for increasingly smaller units. With eight projects currently under development, he has achieved an average size of 100 to 200 square feet. So far focused on smaller buildings with a limited number of units, his latest, in downtown Oakland, Calif., is situated on a 40-by-100-foot site and includes six to eight “bedrooms” and a kitchen. Potter achieves such small unit sizes by considering what can be removed from the unit. A central kitchen, for instance, can be a big space saver, since people are not cooking to the extent they used to, he noted. Having discovered that a shared refrigerator does not make for good neighbors, he includes a small model in each unit, plus a sink (not a “kitchen sink” or a “bathroom sink”—just a sink, said the developer, who maintains that putting labels on the properties or their contents complicates their image). Residents must supply their own dishes, eating utensils and linens, but the central kitchen includes pots...

Revenue Management

Tips from the experts

When you implement a revenue management system, it will change staff roles and how internal data is analyzed and put to use. To be prepared for operational change and minimize disruption, it’s important to have a solid implementation strategy in place pre-launch. Organization-wide training on a new revenue management system is a vital means of empowering your staff to better connect with residents and colleagues. One key reason for having a training strategy in place has to do with the typical turnover experienced in the real estate industry. If the property is running smoothly because the current staff knows the system but then new hires arrive, you must be nimble enough to train new employees quickly and ensure their understanding of the software is thorough. As Jennifer van Arcken, director of information systems for BSR Trust LLC, pointed out, “There are a lot of parameters to set up on each property and if something gets changed then it might not be giving you the right response.” In short, the onsite team needs to know it is okay to pick up the phone and call their manager with concerns. Not only do managers and staff need to appreciate the system, but they also must know how to sell the pricing to prospects. Prior to the establishment of revenue management systems, renters were sold on the bottom line. Now the question that matters is “When do you want to move in?” Prospects may be surprised at first when presented with lower longer-term rates based on an earlier move-in time frame. And they’ll hopefully be incentivized to sign a lease to start almost immediately, even if they still need to vacate a former unit. Your prospects are savvier now, they understand how airlines and hotels operate and...

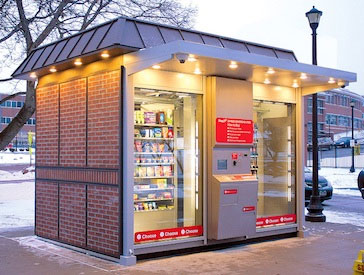

Robotic Age

Power Up Real Estate

You might not have realized it, but there are robots among us. Thanks to dramatic advances in technology, the real estate industry has evolved rapidly over the past few decades, and those changes have not been limited to the smartphone/tablet revolution. The field of robotics has progressed rapidly, too, making it possible for property owners and managers to enjoy the benefits of robots that can mow lawns, take listings photos and even sell sundries to residents in need. Want to learn more about today’s crop of real estate robots? Keep reading to discover our four favorites. The Robot Shop Q: When can a robot be a profit-generating resident amenity for multifamily housing? A: When it takes the form of a robotic convenience store! Imagine supplying residents with a convenient, nearby shop that never closes and never has staffing problems. A place tired parents can visit when they run out of milk, without having to bundle the kids into the car or find a sitter. A place students can grab a snack without taking time away from their studies. A place that generates revenue by providing a useful, fully-automated service. Enter the robot shop. Robotic convenience stores starting popping up at apartment complexes in Texas last year, packed to the gills with everything from salty snacks to cleaning supplies to motor oil. These self-contained shops can be placed indoors or outdoors, stock up to 200 products and are open 24/7 – ideal for high-traffic complexes. Each module is able to accept cash, credit and debit cards. The stores come equipped with video surveillance and can be managed online, in real time. Shop24 Global LLC, the company that produces these robot shops, takes care of all the stocking and maintenance issues, so housing staff can stay...