The ancient Arabian port of Jeddah sits along the Red Sea, waiting patiently for barges and cruise ships. Meanwhile, just a few miles north, desert dust rises up in bursts as new Jeddah City rises up from the amber dunes spread out along the Arabian Peninsula. While the new Jeddah City’s horizon may currently play host to construction cranes and scaffolding, in just under five years a modern oasis will shine amongst the desert sands, greeting tourists, international businessmen and pilgrims on their way to Mecca. In an effort to revitalize this important entry point into Saudi Arabia, the Kingdom City, Jeddah project will include 5.3 million square feet of shops, restaurants, offices, residential apartments unfurling at the base of Jeddah Tower, a 1-kilometer edifice set to seize the mantle of “tallest building in the world.” Previously known as Kingdom Tower and initially designed to be one-mile high, the revamped and slightly scaled-down Jeddah Tower will house a 200-room Four Seasons Hotel, over 300 apartments, and the world’s highest observatory platform jutting out 200 feet above the mouth the city’s man-made harbor. The sleek, futuristic, minaret with a completion date of 2020, will also include several viewing decks and a 250-meter spire striking out into the clouds. The tower is expected to cost about $1billion, with the entire project estimated to sit somewhere in the ballpark of $20 billion. Indoor environment will be controlled via design and technology. Large notches along the exterior will allow for shaded terraces. Cool air at the tower’s peak will enable natural cooling, and the tower’s orientation guarantees no significant surface area will directly face the sun. The structure will also be energy and water efficient, with low-conductivity glass controlling cooling costs and thermal loads, and air conditioning condensate...

2016 Real Estate Trends

New year brings similar questions

For both the residential and commercial real estate markets, 2015 brought questions. Would interest rates rise? Would Millennials buy? Would the market keep rising, or are we on the verge of another bubble? As the year draws to a close, these questions remain, though the prevailing mood is optimistic. While the overall market continues its upward climb, moderation has taken hold. It’s clear the gains and price inflations of the past 12 months are giving way to gradual increases, better credit scores and (slightly) upward momentum. In October, PricewaterhouseCoopers and the Urban Land Institute (ULI) released their annual Emerging Trends in Real Estate report. With an eye towards predicting anticipated real estate trends for 2016, the report’s authors conducted over 400 interviews and collected almost 1500 responses. Participants included investors, fund managers, brokers and consultants. The report’s overall mood? Cautious optimism. “You can never forget about cycles,” declares the report, “but the next 24 months look doggone good for real estate.” Commercial Uprising For the commercial real estate market, positive employment numbers are spurring demand for business centers and high-rises. In New York City, for example, over 9.7 million square feet of office space will be added in the next year – an increase unseen in the city for over two decades. The ULI report authors believe that many of these new commercial spaces will include innovative, modern designs created to lure young, in-demand talent. A combination of “entrepreneurial innovation matched up with industry acceptance,” these buildings will dominate a small, but influential corner of the commercial real estate market, pushing projects and encouraging investment. In order to capitalize on this trend, commercial real estate executives will need to be able to analyze property data, control budgets and make future projections quickly and accurately. With an end-to-end, commercial property management platform like Yardi Voyager Commercial, commercial real estate owners, investors and developers can efficiently manage operation strategies and maneuver funds and resources effectively and profitably. The Rise of the Second City Though New York City and San Francisco are real estate behemoths casting large shadows across their respective coasts, their more humble neighbors will soon steal the spotlight. Deemed “18-hour Cities” in the ULI report, these smaller metropolises are beginning to experience population growth and increased commercial real estate investment – a trend the report anticipates will only grow stronger in the coming year. Hot markets like Austin, Denver or Charlotte, along with mid-sized townships sitting along the borders of Dallas, Atlanta and Seattle, can trace much of this commercial activity to the addition of “round-the-clock” businesses. Restaurants, shops and other professional services are beginning to expand their hours of operation from the standard 12 to 18 or more. For potential residents, access to all the amenities of a larger metropolis like New York City at a more affordable price is attractive. The ability to strategically market to disaffected city-dwellers will be essential to capitalizing on this migration trend. One way real estate professionals, property owners and managers can take advantage of renewed interest in their area is to leverage dynamic, multi-channel marketing with tools like those offered by RENTCafe®. With the RENT Café®, users will be able to entice prospects and retain current residents with marketing campaigns precisely fashioned to highlight the benefits of moving to these up-and-coming second cities. Slice of the Suburbs With all the excitement surrounding the urban real estate market, you’d think the suburbs would be slowly fading into oblivion. Instead, multitudes of Millennials are migrating to the outskirts of town. As this generation finally ages into marriage and family, many of those young urban hipsters will soon be trading in their rented lofts for suburban homesteads. They won’t just be embracing the dream of the white picket fence. These young home buyers will be following the job market. Almost 85% of new employment opportunities continue to be “located outside the center-city core” according...

Hot Properties

Top Listings of 2015

Though seven-figure listings may have dominated this year’s luxury real estate, some mega-homes were forced to downgrade their expectations and their list price. At the same time, other properties and projects still in development held out high hopes for wealthy buyers willing to pay any price for their very own slice of paradise. Palaces, manors and landmarks – they were all up for grabs this year! Say Hello to El Fueridis In Brian De Palma’s 1983 film, Scarface, gangster Tony Montana builds a cocaine-fueled empire that soon lands him in a Miami mansion littered with the flotsam and jetsam of his lavish life of crime. With a beautiful wife, a pet tiger, and more illicit drugs than he can apparently handle, Tony eventually become a victim of his own hubris, uttering his famous last words before tumbling off his ornate balcony into a fountain inscribed with the words, “The World Is Yours.” Though the film was set in Florida, the house is actually located on the opposite coast. The 100-year old haunt, known as El Fueridis to friends and neighbors, was designed by LA Public Library architect Bertram Goodhue and has always been hip to the Hollywood scene. Its “Persian-style” gardens and 24-carat gold ceilings once hosted the wedding of Charlie Chaplin and Oona O’Neil. More recently, the 10,000-square-foot mansion has languished on the market for over a year, its ten acres and innumerable fountains unable to coax potential buyers to fulfill the $35 million asking price. A thirty-percent discount seems to have done the trick: the property finally sold for $12.26 million earlier this year. The Largest Log Cabin on Earth Beyond Abe Lincoln’s wildest dreams, this expansive – and expensive – Granot Loma is technically a “log cabin,” but it’s aspirations are...

Yardi Think Tank

UK Retail Asset Management

The fifth in Yardi’s series of thought leadership Think Tanks, held in association with Property Week, brought together retail centre owners and managers to discuss their experience and opinions on how to remain successful in a competitive retail environment. London’s retail scene is arguably the best in the world, with billions of pounds spent annually in the capital’s designer stores, boutiques and big-brand outlets. But as fashions in real estate strategy change, today’s retail landlords and property managers must move with the times to keep on attracting consumers. In a series of real estate think tanks, Yardi brought together a panel of retail experts to discuss the burning issues. Jace Tyrrell, deputy chief executive, New West End Company Jordan Jeffery, head of retail management, JLL Robin Dobson, director of retail development, Hammerson Clare Harris, head of group marketing & communications, Shaftesbury Chair: Claer Barrett, Financial Times CB: Let’s start by talking about online retail – have retailers and landlords passed ‘peak disruption’? RD: If you look back 10 years, the property industry was scared; now, I think we’ve come through the eclipse. The opportunity to create the best physical stores is complimentary to the drive to online. ICSC research showed that 90% of transactions still happen in a physical location – customers may have seen the product in a store, then ordered it at home or on a screen, or they might have ordered it at home and gone into the store to collect it. John Lewis recently reported that 50% of its in-store sales are coming from ‘click and collect’. As landlords, we create the platform for others to create the theatre. JJ: Everyone has had to adapt to online changes. Today’s consumers are much more informed and do a lot more research...

Global YASC Events

November 2015: YASC ANZ, YASC Asia

November is a busy month for our clients in Australia, New Zealand, and the rest of the Asia Pacific region. Yardi will be offering two Yardi Advanced Solutions Conferences to provide product training, learning opportunities, and networking for clients. The conferences will focus on clients with commercial and investment portfolios. At both YASC ANZ and YASC Asia, attendees can look forward to courses and panels tailored to the experience of product users, IT professionals, managers, and executives. As an added feature to the conferences, labs will be available for scheduling one-on-one demonstrations with Yardi product experts. For the first time, the conference will also offer peer roundtables on a variety of industry topics at YASC ANZ. YASC Australia/New Zealand starts November 16 in Sydney, Australia. All conference activities will be hosted at the Doltone House Hyde Park. This year, the conference has further expanded, providing attendees with four tracks of courses to choose from. In addition, guests will be able to enjoy scheduled entertainment and networking at the YASC ANZ reception on Wednesday, November 17. In less than two weeks, YASC Asia will come to Singapore, November 23-24. Conference events will be held at the Amara Sanctuary Resort on Sentosa Island. To better serve clients, YASC Asia has doubled the curriculum offered this year. The conference will feature four training tracks designed to offer clients specialised courses on Yardi software and services. Besides courses and panels, YASC Asia attendees can take advantage of discounted spa treatments at the host resort and the many networking opportunities available at the conference and cocktail reception. Follow Yardi’s social media channels for conference news, events, and information. You can follow Yardi on LinkedIn, Twitter, Facebook, Instagram, and Google+. Be sure to tag your photos on social media with the YASC Australia/New Zealand event hashtag, #YASCANZ, and the YASC Asia event hashtag, #YASCAsia. About Yardi: Now in its fourth decade, Yardi® is committed to the design, development and support of software for real estate investment management and property management. With the Yardi Commercial Suite™, Yardi Residential Suite™, Yardi Investment Suite™ and Yardi Orion® Business Intelligence, the Yardi Voyager® platform is a complete real estate management solution. It includes operations, accounting and services with portfolio-wide business intelligence and platform-wide mobility. Yardi serves clients worldwide from offices in Australia, Asia, Middle East, Europe and North America. For more information, visit www.yardi.com/anz and...

Prologis

Sustainability starts at home

Prologis, the global leader in industrial real estate, is a master of sustainable growth. With more than $56.0 billion in assets under management and 670 million square feet of real estate, the Yardi client has never been stronger. Prologis has consistently focused on delivering quality products and exemplary service to its global customer base. The company has earned international accolades for sustainable business practices, smart management and global competitiveness. I recently sat down with Arthur Nelson, VP Global Business Systems, for insight into their success. Progress on a global scale Corporate Knights Global 100 has named Prologis one of the World’s Most Sustainable Corporations for seven consecutive years. Prologis outperformed its international peers across 12 key performance indicators, demonstrating that the company’s enduring focus on sustainability is working. “We place high value on being a responsible corporate citizen,” Nelson explained. “One key element of that commitment is developing to internationally recognized sustainable building standards including LEED, BREEAM, CASBEE, HQE and DGNB, with the goal of certification.” In 2014, the company achieved sustainable building certifications for 27 new projects totaling 9 million square feet. The Prologis platform now boasts more than 53 million square feet of sustainable building certifications. Resource reductions are a consistent corporate priority. By the end of 2014, 68 percent of the company’s global operating portfolio had been upgraded to energy-efficient lighting. Prologis’ rooftop solar initiative has interconnected over 112 megawatts of renewable energy since 2007. In total, energy savings from energy-efficient lighting and renewable energy systems is equivalent to 400 million kWh. Cool roofing covers more than 31 percent of the company’s rooftops, reducing energy use by up to five percent in air conditioned spaces. In addition, Prologis has set goals to: Reduce energy consumption across the global portfolio 20 percent...

Magic Kingdom

Disneyesque real estate

The Yardi Advanced Solutions Conference is being held in Anaheim, Calif. this week, just down the street from the Happiest Place on Earth. Yes, we’re talking about Disneyland. If you grew up in Southern California or are raising a family here, chances are you may have had occasion to visit the flagship Disney theme park a time or two. Now that I’m older and more interested in mergers and acquisitions than Minnie Mouse, Disneyland doesn’t hold the same thrall over me that it once did. But as I thought about the many memories there, the unique sense of place fostered by the park’s attractions was on my mind. Could you find a Sleeping Beauty Castle on the real estate market? How about a Tom Sawyer Island? Even a Haunted Mansion? I went looking for the comparable properties to some of my favorite Disneyland spots. Here’s what I found. Sleeping Beauty Castle Fit for a princess, Disneyland’s Sleeping Beauty Castle is like a life size Barbie dream house. When I was growing up, it wasn’t open to go inside – apparently it’s now open to visitors for walking tours, though some reviewers complain that there’s not much to do in there. Well, Sleeping Beauty was asleep, after all.. I found a castle for sale in Burgundy, France that might fit the bill of a modern princess (Kim Kardashian?). Two hours from Paris, the 9-bedroom, 7-bathroom home comes with its own lake, two guesthouses, a barn and a stables. But it wasn’t owned by a fairy tale character – French biologist Louis Pasteur, who made milk safe to store with his pasteurization technique, was the original proprietor. Price is available from international real estate firm Moulin upon request. Tom Sawyer Island You don’t have...

Yardi Think Tank

London's apartment market

LONDON – The burgeoning demand for rental property – particularly in London – means developers of build-to-rent schemes have a captive market, but everything else from valuation to finance and planning seems to be stacked against the sector significantly expanding. What do the pioneers of this form of development have to tell us about the state of the UK housing market and housing policy, and how are they overcoming the odds to deliver profitable schemes? Panel participants: Claer Barrett, Financial Times – Chair Dominic Martin, Operations & Strategy –Westrock Neil Young, Chief Executive – Get Living London Ryan Prince, Chief Executive and Co-Founder– Realstar Living James Scott, Chief Operating Officer –The Collective CB: There has been a lot of noise about ‘build to rent’ as a policy, but correspondingly little development in the private rented sector (PRS). Why is it so challenging financially? RP: It is uneconomic for PRS developers to compete with housebuilders. By our estimates, they can pay 30% more for a site. Then there is the time it takes persuading the planners. When you actually do the math, taking planning, construction, leasing risk and time into account, returns can actually be pretty poor. Most new PRS schemes are either government-procured PRS, where land is marketed on the basis that it will be PRS instead of homes for sale, or part of large-scale regeneration projects. If you remove those specific circumstances, you have no real meaningful, scalable policy framework to have a PRS industry in the UK. I think it gets disproportionate headlines relative to its size. DM: We still do not have clarity for PRS in the planning process. The London mayor’s supplementary planning document is starting to go in our direction, but it is still only guidance. Local authorities can do...

Fall Staging Tips

Property Management

As a property manager, taking the time to stage your property shows prospects that you’ve got it together. You are prepared, detail-oriented, and organized. You want guests to feel welcomed and comfortable on your property. Such nonverbal marketing turns prospects into tenants. The decorating tips below will make your last-minute fall decorations quick and simple. Interior Decor Your property is likely one of a dozen that a tenant has considered. To make your property memorable, skip the obvious choice of fake pumpkins and scarecrows. Step outside of the average color palette by adding purple and gray to your autumnal arrangements. Use gray as your neutral instead of (or with) black, white, or brown. Purple is a beautiful contrast to fall’s popular reds, oranges, and yellows. Art it Up Wall art is easy to change out with each season. Choosing art with fall colors is a subtle way to celebrate the season even if the subject of the painting does not include fall imagery. Comfy and Cozy Play with the arrangement of throws and quilts. These little touches can instantly transform a nondescript couch into a welcoming retreat. Quilts can also double as wall art. A Savory Smell Scent creates a strong bond to memory. A few carefully placed candles or essential oil diffusers will go a long way towards creating lasting memories for visitors. Pumpkin and apple scents are always a favorite at this time of year. For a more creative touch, consider clove, anise, fennel, and other cooking spices that are common during holiday meals. Exterior Decor Exterior designs can be tough: brown grass, sparse foliage, dry–or worse, soggy–leaves on the ground. In some areas, the best thing that you can do for your property is to keep it tidy: frequently...

New Mexico Rising

Albuquerque's real estate trends

ALBUQUERQUE, NM – The Platinum is not your typical Albuquerque apartment complex. It is four stories, expected to be LEED-Platinum certified, with city and mountain views: in other words, a modern marvel that will draw some of the city’s highest rents. It’s surrounded by Nob Hill, Albuquerque’s most walkable urban neighborhood. The area is a mix of higher education, restaurants and service businesses along Central Ave., also known as historic Route 66. “This is Albuquerque’s main street,” says Rick Goldman, developer of The Platinum and two other nearby condo and loft projects. “Usually, retail follows rooftops. But in this town, you had retail on Central, but no rooftops to speak of.” Albuquerque has sprawling single family housing tracts spread across the city. High density apartments rising above two stories tall are rare. Your typical Albuquerque apartment complex, says longtime broker Todd Clark, “was built in 1970, is two-story, brick, with a pitched roof, master-metered and originally offered furnished. It’s an island surrounded by a sea of parking.” So is the Platinum a symbol of things to come in New Mexico? Maybe. But there are challenges ahead before Albuquerque can be considered a transit-friendly, walkable urban destination. Breweries and buses How can you tell when a city is poised for an influx of millennials? CBRE’s Billy Eagle, who specializes in multifamily sales, suggests that you might want to track brewery openings. “During the last two or three years we’ve seen the breweries expand five-fold. I think there are now more than 25 in town,” says Eagle, who relocated to Albuquerque from Southern California eight years ago, when he was in his early 20’s. He talks enthusiastically about cycling around downtown, weekly farmer’s markets, new restaurant openings and Uber: all hot with Millennials. During his time...

Making Waves

Man Made Surf Comes Austin's Way

Until recently, surfing has been an activity limited to the lucky ones with oceanfront access. This is about to change with some incredible technology created by Spanish engineering firm Wavegarden, which has the capability to deliver the longest man-made surfable waves on Earth. Sounds surreal, doesn’t it? Doug Coors, a descendent of the Coors Brewing family, made it his mission to put Austin, Texas on the surfer’s map by bringing the ocean-bound sport inland. The self-proclaimed engineer and surfer, founder and CEO of NLand Surf Park, LLC said it took him 15 years to find the proper technology to mimic an actual surf break. He found it in Spain and decided to bring it to North America. Coors plans to raise these waves for the public starting next year. Why Austin? Austin has become a powerful magnet for investors and tourists, a weekend heaven for festivals and activities of all kinds – from SXSW to triathlons for the disabled, biker rallies, and Eeyore’s Birthday Party. Sports lovers and creative entrepreneurs have made Austin their home partly due to the willingness to give new ventures a chance, no matter how ambitious they are. Probably the best example to sustain this perspective is the recently completed Circuit of The Americas Formula 1 track, the first in the country to be built specifically for F1 races. Interesting is that it is located down the road from the proposed NLand Surf Park site. The lagoon will be located east of Austin-Bergstrom International Airport on rural property as big as nine football fields. The complex will offer 11 different surfing areas, with four different surfing levels, designed to create every 60 seconds perfect waves ranging between one to six feet high, with a surfing experience of 35 seconds per wave; think 300 distinct waves per hour. The technology behind the massive lagoon has been created in collaboration with the team and tech at Wavegarden in Spain, who proved its capabilities through the thousands of waves it has pumped in the Basque Country wave park. One of the most intriguing and fascinating facts about NLand Surf Park is the claim that, after the initial fill, the park will be self-sustaining with rainwater, even during tough drought conditions. Imagine surfing on raindrops. “Our top priority is water and water conservation,” Coors told Think Progress. “The surf community is very environmentally conscientious and they pride themselves on environmental stewardship. We want to fit in with that as much as possible.” With the water consumption solved, energy use comes next. Water is heavy and moving it needs energy; the ocean has the sun and the wind to create the waves, how will this massive project be fueled? Even though Wavegarden’s CEO Josema Odriozola said that the energy consumption in the company’s technology is much lower compared with the other existing wave generation technologies, the matter is a hot subject. One solution would be to make the park use solar power by placing panels on the unused land; however, this part of the project has not been nailed down yet. Coors has been discussing with three solar providers to determine the possibilities. Austin-based White Construction Company was chosen to execute the project within eight months with approximately 90 construction craftsmen and professionals on site. The undertaking is privately funded. Backing for the project is provided by 9th Street Capital, a Colorado-based private equity firm where Coors is president. Opinions on the project are diverse, ranging from excitement to anger, but the project will happen. NLand Surf Park will be just like an indoor rock climbing gyms – perfect for training. Sounds like it will be a destination for all the surfers who have relocated in Austin, until they make it back to Mother Nature’s...

UK Asset Management

Recovery + Reinvention

Asset Management companies in the UK have experienced several years of growth due to foreign capital flowing into the country during the lean years. As rents stabilize, the rate of growth is clearly unsustainable. Yardi brought together several asset management experts to discuss how asset management will reinvent itself during economic recovery and prosperity. According to Richard Williams, managing director asset services UK, CBRE , The answer boils down to the company’s country of origin. Far Eastern and Middle Eastern investors continually require traditional asset management services. “That’s where most of our team’s work has come from in the last year. Although they tend to buy trophy properties, we spend a lot of time teaching them the fundamentals of asset management. It’s impossible for them to do this from Asia where they’re based.” Locally, there is a different story. Shaun Hose, director of asset management, BNP Paribas Real Estate, explains, “Now, the market has improved to such an extent that the yield shift alone won’t meet target returns. Institutional investors are looking for assets they can intensively manage and have levers to pull. The regions are high up on the agenda for UK investors as occupier markets come back, but London markets continue to be dominated by foreign investors.” This leaves local investors seeking a select few assets that will offer the value that they need: core plus assets with both income and an angle, and doughnut assets that are inside the M25, but outside of central London. Such properties include multi-let industrial, or distribution centres, with their low vacancy rates, resilience, and growing popularity. Such centres are often occupied by online retailers, powerhouses whose bravado is far from diminishing. There is also a notable amount of obsolete properties that could use a second wind....

Data Leasing

Less Space, More Business

Large retail centers used to be revered for their prestige and variety. Getting to the 2 million-square-foot Sears and Roebuck center in Atlanta, GA was once a pilgrimage for consumers throughout the region. The days of such super-sized department stores are long gone. With the growing popularity of online shopping, brick-and-mortar stores are steadily shrinking. This trend is likely to continue but that doesn’t mean that REITS and owners will see less cash flow from their vast, existing properties. Data leasing, the new frontier, is proving to be a gold mine full of possibilities. CBL & Associates is introducing the Digital Star program at its properties. It is a set of fiber paths, routers, and related infrastructure that is made available to tenants in CBL properties. Three shopping centers are piloting Digital Star this year. “The new space for lease is all digital,” says Mike Harrison, Senior Vice President at CBL. “It’s a whole new way of thinking. It’s in high demand.” The average demand ranges from 4-10 megabytes for most retailers but there are tenants such as Microsoft and Apple that need well over 100 megabytes. To meet the growing demand, CBL has teamed up with Granite Communications to provide data management and services. Together, they offer tenants brick-and-mortar stores with a range of digital capabilities. The duo is constantly thinking on its feet. The need for data will only increase as retailers explore methods in which digital and online tools can enhance the customer experience and improve the efficiency of operations. Consumers motivate the bulk of data demands. Even when they are inside of a store, consumers continue to shop and research online for product reviews, detailed product descriptions, and offers from competitors. In addition to in-store wi-fi, consumers expect increasingly interactive...

Self-Storage

High Demand, Limited Supply

The cat is out of the bag. Self-storage is a hot industry with hefty returns and minimal operating costs. If you haven’t explored the possibilities in this sneaky big market, you may be running out of time. Vacancy rates have gradually declined in the past seven years as rentals proved to be a more favorable option for young adults, empty nesters, and those facing financial challenges during and after the recession. Even as the economy regains its health, self-storage continues to do well as people relocate for work or for more comfortable living. By the end of 2014, self-storage occupancy reached a historic high of 90 percent. Yardi client Morningstar Properties president Dave Benson weighs in, “It’s really been strong occupancies and good demand as housing comes back, as jobs come back and people start to move around a little bit,” he says. 2015 has enjoyed a great start. Morningstar Properties exceeded its capital goal for a $75 million private-equity fund that will acquire at least 10 properties. Other Yardi clients also have ambitious plans for the year. Cubesmart has begun a 36-property acquisition from Chicago-based Harrison Capital. Ernst & Young Capital Advisors spotted LifeStorage LP with $120 million in equity to expand operations across the nation. Yet as institutional investors with diverse portfolios continue to pounce on Class A opportunities within the sector, top-notch assets have become harder to find. New developments are being built prospectively, often scooped up before being marketed. Second quarter of this year, we may see the self-storage behemoth lose its fangs, at least temporarily. Cap rates are declining and new construction is slowly forthcoming. “We were seeing stabilized assets trading at 5.5 percent cap rates, where this sector doesn’t usually see rates of less than 6 percent,” reports R....

3D Printed Apartments...

A reality in China

Gutenberg invented the printing press in 1439; since then the printing industry has evolved, from printing blocks to 2D printers with the capacity of mass-producing documents in just minutes. Today, 3D printers are capable of creating pretty much anything, from mechanical parts to prosthetics to buildings. Even though it’s been 32 years since an engineer named Chuck Hull invented 3D printing, only recently the process became one of the industries of the moment for investors. From 2011 to the present day 3D printing has raised almost $4 billion, while during 1987-2010 (23 years) it raised only $300 million. Increase in interest by public investors translates into extraordinary potential and profit in the industry. 3D printing advocates say the technology will be routinely used to build homes, food, and human tissue and believe that it has the potential to revolutionize how we do everything. A good example is General Electric, which announced that it is using this technology to make the next generation LEAP airline engine that will save fuel consumption and expense. Probably the even better news is that 3D printing is no longer reserved for corporations only, but available to all. A Chinese construction firm, WinSun Decoration Design Engineering, unveiled a five-story apartment building, dubbed “the world’s tallest 3D-printed building,” along with a 11,840-square-foot neoclassical mansion, both made entirely with a giant 3D printer. The properties were built with a patented ink created from a combination of recycled construction waste. This project follows last year’s revolutionary initiative when the company built 10 affordable houses in 24 hours, each of 650 square feet at around $4,800. For the affordable project the company used four 3D printers that measure 20 feet in height, 33 feet in width, and 132 feet in length. The process is...

Townhouse Trends

New Competition for Rentals

National multifamily rents are no longer skyrocketing at breathtaking rates. The news could cause renters to send thank you letters to the powers that be, if they knew who or what those powers were. Primarily, renters can thank a boost in multifamily development which is helping to balance supply and demand. Secondly, they can thank the competition posed by the single-family housing market. A growing demand for townhomes has increased the properties’ market share in sales. According to REALTOR.org, existing single-family home sales are up by 5.2 percent and distressed property inventory has decreased by 23 percent compared to this time last year. The recent stats demonstrate that homeownership is now more accessible for many, particularly when it comes to existing properties. New construction is also becoming more accessible. Total single-family attached construction was up 17 percent on a year-over-year basis by the fourth quarter of 2014, census data reports. Townhouses may soon constitute 11 percent of all single-family developments, inching slowly towards the most recent high of 14.6 percent of market shares last seen in early 2008. The total market share of townhouses is expected to continue its gradual rise in years to come. When looking at market trends, the growth of townhouse sales makes sense. Townhouses offer an ideal compromise between features that both Millennials and Boomers crave in rentals and single-family properties: -Townhomes fit well into urban environments, where so many Millennials and Boomers have set their sights. Single-family attached properties work well in metropolitan infill lots that are on the smallish side for apartment complexes yet are too profitable for one single-family home. -Townhouses come with less yard space than a traditional house, minimizing the amount of time and money that owners must dedicate to maintenance. -Pet owners appreciate that yard space...

e-Commerce Delivery

From Drivers to Drones

The NAIOP Commercial Real Estate Development Association recently held its second annual E.Con in Atlanta, a conference dedicated to e-commerce innovation. During the two-day event, last mile delivery stayed at the forefront of conversation. As the nation faces a shortage of 240, 000 truck drivers, e-commerce companies are actively seeking alternatives to traditional delivery methods. Panelists and attendees discussed four current trends: Unmanned vehicles The lack of CDL drivers and the high costs of employing them are leading e-commerce retailers to seek other ways of getting products from distribution centers to the homes of consumers. Removing drivers altogether could be the solution. That’s one approach that has been tried in Europe and Asia. Those programs started 10 years ago. Unmanned vehicles still haven’t caught on because studies (and many companies) suggest that automated trucks are most suitable for interstate conditions. The last mile in urban and suburban areas has risks associated with pedestrians, frequent construction and redirects, varying laws, and erratic behavior from human drivers nearby. More research and innovation will be needed to make companies and consumers comfortable with unmanned delivery vehicles in heavily populated areas. Uber-style delivery systems Independent delivery services are also popping up across the nation. Drivers for hire (those with a standard non-commercial license) can carry out deliveries from urban and suburban distribution centers to doorsteps. They do not require the pay or hours of career truck drivers. Start-ups and smaller e-commerce companies are exploring these options. They may become more prevalent in the future. There is one major problem. Currently, there is no software that coordinates product size, weight, and shipping distance with these drivers for hire. Everett Steele, CEO of Kanga says, “There is this idea, ‘I want to be the Uber for delivery,’ but one of...

Payment Processing

Collections Simplified

For managers, collections can be the most tedious part of the job. Skips, delinquencies, bounced checks, NSF alerts—there are few pleasantries surrounding the process. Fortunately, there are several tools in place to streamline collections, resulting in hands-free, automatic transactions. Say goodbye to the antiquated practice of depositing checks and say hello to the digital future of collections. Property managers have several options when selecting a check-free payment system, each with unique benefits and challenges. Many properties have the best success by offering a combination of payment options from which residents can choose. Rent from Payroll An NAA Education Conference and Exposition study suggests that rent from payroll can decrease delinquencies and rent-related evictions by 77 percent. For managers, withdrawing rent directly from payroll assures that rent funds won’t become discretionary income for renters. The process also minimizes human error and complications during the transaction. While those points may be enough motivation to explore this option, the benefits don’t stop there. For residents, rent from payroll can take the place of traditional credit qualifications. Some properties use rent from payroll in lieu of a cash deposit, which is appealing to many renters since cash can be tight during relocation periods. The downside is that some renters will not want to enroll. 65 percent of the time, rent from payroll holds 74 percent of the next month’s rent, reports Units Magazine. Not having access to those funds could be a deterrent for renters. Automated Clearing House (ACH) More than 22 billion ACH transactions are completed each year, making it one of the most popular options for electronic bill payments. As with rent from payroll, you’re still eliminating the human-to-payment interaction, decreasing the margin of human error and freeing up time for onsite staff. The greatest difference...

Stars to Watch

Commercial Property Executive

This week, Commercial Property Executive unveiled this year’s Stars to Watch, 17 up-and-coming individuals and teams from across the commercial real estate industry that are sure to make more waves as they climb the career ladder. Like others recognized by this decades-long program, these 40-and-unders are exhibiting insight, creativity and dogged determination in completing deals and building businesses, often simultaneously seeking to give back by mentoring others, serving on other companies’ boards and involving themselves in their communities and social causes. Following is the list of CPE’s 2015 Stars to Watch. You’ll want to read about their accomplishments, featured in CPE’s February 2015 issue. Christopher Bellapianta, Director of Finance and Acquisitions, Advance Realty Georgia Collins, Senior Managing Director, Workplace Strategy, CBRE Group Inc. David Colman, Michael Colman, Tyler Ross, Principals, ROCO Real Estate Mathew Crosswy, President, Stonehill Strategic Capital Malcolm Davies, Principal, George Smith Partners Christine Espenshade, Vice President, Capital Markets, JLL Seth Grossman, Managing Director, Meridian Capital Group Michael Hart, Senior Managing Director, Corporate Occupier & Investor Services, Cushman & Wakefield Inc. Nicholas Hoffer, Senior Managing Director & COO, Hunt Mortgage Group L.L.C. Patrick Luther, Managing Director, Faris Lee Investments Benjamin Miller, Co-founder & CEO, and Dan Miller, Co-founder & President, Fundrise Nitin Motwani, Managing Principal, Miami Worldcenter Associates Taylor Snoddy, Managing Director, Transwestern Robert Stamm, Executive Managing Director, Savills Studley Lauren Staniec, Sustainability Coordinator & Enhancement Project Manager, Pyramid Management Group Armand Tiberio, Senior Vice President, Investments, Marcus & Millichap Real Estate Investment Services Inc. Craig Wilson, Executive Managing Director,...

David Antonelli

Bentall Kennedy

Early in his career, a well-meaning mentor suggested to David Antonelli that he might consider focusing on finance, rather than real estate, so he could easily transition between asset classes during variable economic times. “In the end, I liked real estate so much that I nodded politely and went on with my career. Twenty-five years later, I’m still in the real estate business,” said Bentall Kennedy’s executive vice president and portfolio manager for its Multi-Employer Property Trust (MEPT), the firm’s open-end commingled private equity real estate fund and one of the largest of its class. Antonelli talked to us about the high-performing MEPT and where it is focusing its investment dollars. Give us a brief synopsis of the background of the MEPT fund and its investment emphasis? Antonelli: MEPT is an open end, core private equity real estate fund that invests in institutional quality commercial real estate throughout the United States. The investment objective of the fund is to provide competitive, risk adjusted total returns throughout all real estate cycles. The fund was founded in 1982 by Bentall Kennedy and it now has over $6.8 billion in gross assets, along with 320 investors, which makes MEPT one of the largest private equity real estate funds in the U.S. What has the fund’s return rate been to date? Antonelli: Since its inception, the fund has produced a 7.85 percent total return, and over 90 percent of that total return has come from fund income. MEPT’s total return, I think it’s important to note, exceeds most pension plans’ actuarial assumptions. The fund’s investment strategy is focused on maintaining strong and stable income, building a diversified modern portfolio, providing superior liquidity, and it’s also executed with strong commitment to the principles of responsible property investing, similarly or...

Commercial Comeback

Detroit on the move

Ed. note: The third in a three-part series, our final article on the real estate realities for Detroit, Michigan, as the city emerges from a long period of decline. Read the first installments here (Part 1) and here (Part 2). Walking around downtown Detroit, at many times of day, feels like one has wandered onto a deserted movie set. Historic skyscrapers loom overhead. There are hints of change and progress: work on a new rail line, construction fences around old buildings, for rent signs in windows. What you don’t see, that feels strangest of all, are very many people. At 8 a.m. and 5 p.m., there is foot traffic as employees walk to or from their jobs. A great many of them are wearing Quicken Loan employee ID badges, identifying them as part of Dan Gilbert’s empire. Gilbert’s investment in the city, from real estate purchases – more than 50 buildings to date – in addition to centering Quicken’s headquarters downtown and funding a large portion of the M:1 RAIL line, is ubiquitous. “Dan Gilbert obviously is leading the charge in downtown real estate reinvestment. He’s acquired 52 properties in the last couple of years, for Quicken and various subsidiary companies of his own,” said John Latessa, Senior Managing Director of CBRE’s Michigan operations. The other major property accumulator, the Caesars Pizza-founding, sports team-owning Ilitch family, has been buying up lots and decaying buildings for a new hockey stadium for years. “(Gilbert and the Ilitches) are generating the interest that didn’t exist before. If they weren’t doing this stuff and couldn’t do it on their own, a lot of these other projects wouldn’t be possible,” said Scott Allen, president of Fourmidable, a Detroit-based multifamily property management firm. Rising rents for multifamily Detroit’s real estate...

Inspect and Invest

Accessibility for all

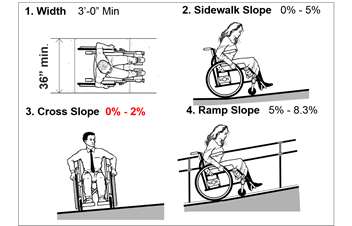

No owner wants to wake up to surprise expenses or costly lawsuits. You can avoid both by staying on top of your property’s accessibility compliance standards. Across the nation, well-intentioned multifamily professionals are facing citations and fines for noncompliance. Many are surprised to discover that employing licensed architects and contractors does not automatically mean that their properties are compliant. Mark English, President at E&A Team, Inc., has specialized in accessibility compliance inspections for more than 22 years with operations in all 50 states. He has witnessed beautiful new construction with notable accessibility violations. Often times, it’s an issue of communication rather than competence. “A lot of developers are very cloak-and-dagger about where they’re going to get their money because they don’t want everyone to know. So sometimes architects, contractors, and engineers who are asked to build something may not bother to ask the question, ‘What sort of funding do we use?’ That’s a majorly important question!” These experts can’t meet stringent accessibility regulations for specific types of federally funded projects if they don’t know what type of project they’re creating. On-site staff is often completely unaware that there is a problem until a resident or employee files a complaint. Their complaints are generally followed by lawsuits so it’s better to address issues early. Throughout his career, English has witness two common violations that cause problems on many multifamily properties. The first is a lack of cane detection under stairways. “For the visually impaired, you’re required to have a minimum of 80 inches of vertical clearance along an accessible route. If you have paving or concrete under a set of stairs, that would lead a person with any visual impairment to assume that they can walk right under the stairway. The goal is to have...

Professional Advancement

Advice from able leaders

Problem: You want to be a greater asset to your company but the path to success seems unclear and you feel like you’re spinning your wheels. Solution: Advance your career by developing leadership skills that will prepare you for promotion. The skill set of a solid leader stands out on a resume or CV, and the effects of good leadership are often quantifiable. The Balance Sheet caught up with managers and executives throughout the industry to reveal the most sought-after leadership traits that will help you get ahead and lead with confidence. Getting Started Most of today’s leaders began as deck hands, so to speak, performing intro-level tasks while struggling to find ways to shine. John Crossman, President of Yardi client Crossman and Company real estate firm, believes that you don’t have to be the best student or the most flawless employee in order to catch your boss’s attention. Work your way up the ranks by developing servanthood and passion. “Being willing to learn and serve, helping your team, will provide you with the insights needed to do your job well and build a strong professional network,” begins Crossman. “Then when your knowledge and experience are coupled with passion, you will be unstoppable. When you’re passionate, that overflows to the entire company. That’s crucial to success in every area.” Integrity is another characteristic that can place you in better standing with your peers and your superiors. Chuck Fuhr, former Division President of Ryland Homes, Atlanta, served more than four decades in the real estate industry. He notes that professionals with integrity are priceless. They prove to be a solid, long term investment for companies. “A leader needs to have high integrity. Team members need to know their business or organization is being run in an honest and fair manner,” says Fuhr. Unethical or questionable behavior is like duct tapping a broken rudder. It may work for a moment but the situation is likely to get out of control. So much in the world of real estate is tight-knit and interrelated social networking. Bad dealings and poor relationships will place you at a disadvantage later. Don Rogers, General Manager at Yardi, Atlanta, also acknowledges integrity as an essential characteristic of a good leader. “A leader must be honest, be consistent, and do the right thing for your employees and customers,” says Rogers. But even the best leaders may have a hard time discerning what is right, which brings him to another valuable feature: good communication skills. “It’s a common misconception that good leaders always have the answers,” Rogers says. “I don’t always have the answers but I try to take the time to learn the facts and make a reasonable decision after hearing them. So it’s equally important to have good communication – to be honest, and be open—and to empathize with others. Remember where you came from when working with your staff, and try to understand the other points of view.” Full Speed Ahead Once you’ve secured your first management position, working further upwards is a matter of strategy and careful planning. Laquna Marrable, Assistant Director of Human Resources and Employment Services, has hired for international corporations as well as private institutions. She has noticed that companies of all sizes prize strategic thinkers. “It’s important for leaders to be able to see the importance of what they’re doing right now as it relates to the overall goals and missions of the company,” says Marrable. “They must be able to closely tie every project, every assignment, every team member, to the overall mission or objective. For example, ‘I’ve got Mrs. X working for me and she’s responsible for this. The responsibilities of this position relate to our mission because of Y and Z. By accomplishing her tasks, we’re 20 percent closer to the end result.’ That strategic approach enables leaders to make sure that everyone is on task working towards...

On the Urban Prairie

New uses for open space

Drive out of Detroit’s Downtown and Midtown neighborhoods, away from the historic skyscrapers and abandoned ruins of once-grand buildings, and you are quickly amidst a whole different kind of surreal scene. Once densely packed with people, Detroit’s outlying single family home neighborhoods have suffered immensely from the city’s ongoing depopulation. Across the city’s 149 square miles, nearly every neighborhood had 15 percent of its homes abandoned or foreclosed. There are still an estimated 80,000 structures left standing. This summer, the federal government pushed Detroit to spend $850 million to tear down 40,000 of them in the long slogging war against blight. Adam Hollier, Detroit native, Cornell graduate, and former City Council liaison for the Detroit Mayor’s office, sees the city’s sparsely peopled suburbs as an opportunity for change, and a new way of looking at urban life – one with plenty of open space. Hollier’s new job isn’t in politics or real estate, but on Detroit’s vast urban prairie. Working for Hantz Farms, he leads a small team that planted 15,000 trees this summer in one of Detroit’s declining western neighborhoods. Hantz Farms purchased 1700 parcels, totaling 150 acres, from the city to create their “Woodlands,” where the grass and trash that covers houseless lots has been cleared. John Hantz, CEO and owner of Hantz Farms, lives in Indian Village, a historic neighborhood just a few streets away. “What we’re doing clears the way so that other people can invest in the neighborhood. The goal is that that will bring other investment in housing or commercial real estate. It’s very similar to what Dan Gilbert is doing downtown, in that you know you’re throwing good money after good money,” Hollier explained. The results of the clearing are impressive. From a lot that hasn’t yet been worked over, overgrown bushes spilled onto what would have once been a neighborhood street. Trash is everywhere – old tires, pieces of burnt wood, broken glass bottles. Five houses might now sit on a street where there were once 25, shoehorned into tiny 30’’ by 60’’ lots. It’s on the blocks where the debris has been cleared that the urban prairie really looks like a prairie. “Now you can see four, five, six blocks in any direction,” Hollier pointed out “And if you don’t talk for two seconds it sounds like you’re in the country. Which is a really weird thing when you’re four miles from downtown.” Over the next two summers, the Hantz team plans to plant an additional 30,000 trees. Some parcels may be used for farming – two ventures, growing mushrooms and hops – are in the planning stages. Produce and jobs Hantz Farms isn’t the only company working on new life for the urban prairie. Gary Wozniack is a man with a dream of repurposing 310 acres of vacant, city-owned land for high-yield agriculture, and simultaneously creating up to 700 jobs, most paying $10 an hour. It’s a 20 year plan that will begin in to ramp up with the first 25 acres over the next year. The work would be suitable for employees with limited education and professional skills, including those who have done prison time or struggled with addiction, a type of opportunity that is sorely needed but rarely available in Detroit. “We have a huge untrained labor force, probably upwards of 200,000 adults in the city,” said Wozniack, a native Detroiter and RecoveryParks President/CEO. This summer, the unemployment rate has hovered above 14 percent. This fall, RecoveryPark expects to finalize its initial land deal with the city, purchasing the farm’s first 25 for just $1. The purchase will include the crumbling historic Chene-Ferry Market, an open air structure covered with trash that will become a headquarters for the operation. The neighborhood where RecoveryPark will grow is even harder hit by abandonment than Hantz’ Woodlands blocks. It’s located on the city’s near east side, not far from the...

Divining Detroit

Motor City's Second Act

The first thing you learn in Detroit is that you don’t know anything about Detroit. Most Americans – even many Michigan residents – perceive the city as crime-ridden, crumbling, conundrum. Spend a day or two in Detroit and you’ll likely come away with a different impression: one of a place that, as one lifelong resident put it, “has gone through hell, and now, very quietly, there are pockets of rebirth.” Rebirth, encore, renaissance – these are the kinds of words you hear a lot of when talking to passionate Detroiters. Their enthusiasm is infectious. The city’s transformation from a metropolis of 2 million to a city of 688,700 (and falling) – and what comes next – is a story that fascinates. Comebacks, after all, are one of America’s favorite plotlines. The real estate broker Austin Black II has a problem, one that most residential real estate agents or brokers in America would envy: he needs more condos and lofts to sell, because buyers are beating down his door. From 2013 to 2014, Black’s business at City Living Detroit, a full service residential brokerage specializing in the greater Downtown and Midtown neighborhoods, has jumped more than 25 percent. “It would be higher if there was more inventory. The average sale price is up substantially over last year,” Black notes. In fact, the prices for the units he has sold – starting at $200,000 and going up to $600,000 – are virtually unheard of in still-struggling Detroit’s single family home market. The reasons are attributable to the two oldest themes of real estate: supply and demand, and location, location, location. Since the 2008-2010 economic slump, just one new for-sale condo project has come online in the coveted Midtown area, home to Wayne State University and Detroit Medical Center. Other housing projects under construction are rentals, and while rents are on the upswing, Black says his clients would prefer to buy. “Pre-recession, most buyers were all young professionals, either right out of college or not too far out. That market has changed drastically to include young professionals, mid-career professionals, established executives and empty nesters. It’s a very diverse market now, more typical of what you see in other major cities,” Black says. He’s even seeing many locals moving back toward the city from the suburbs, lured by a low-maintenance multifamily lifestyle. There are incentives to urban living for buyers and renters alike. Nine major Detroit employers participate in a program that provides a $20,000 forgivable down payment loan for a home purchase near the commercial core, or a rental subsidy paid directly to the landlord. Adding to the future appeal of the neighborhoods Black sells is the ongoing construction of the M-1 RAIL, a 3.3 mile long circulating streetcar along Woodward Avenue that will begin to link the downtown core with the outlying suburbs. Considering the vast expanse of territory that makes up Detroit – the city is 149 square miles in size – it’s just a start to fixing a chronic transit problem. If you live or work in Detroit, locals say, a car or bike is the only way to efficiently get from place to place right now. The evangelist Jeanette Pierce grew up in Detroit and spent most of her 20’s living in the heart of downtown. She loved the lifestyle so much that she turned her passion into a full time job: reputation management and education about what’s really doing on in D-town. Today, she and her husband, a scientist, are homeowners in Lafayette Park, a downtown adjacent neighborhood that’s just a few blocks from the businesses, casinos, stadiums and hotels in the downtown core. Jeanette calls Detroit “MY city” with the ferocity of a mother bear protecting her cub. She started her tours to show fellow locals that “we’re not martyrs” for choosing life outside of suburbia. Her business is now part of a foundation-funded non-profit, D:Hive,...