Yardi Matrix

Your ultimate real estate data source

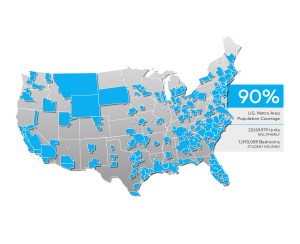

Yardi Matrix offers an industry-leading data solution designed to power the success of real estate professionals across multiple markets. Whether you’re an investor, developer, broker or property manager, our comprehensive, accurate and timely data gives you a competitive edge in the multifamily, affordable housing, student housing, self storage, office, industrial and vacant land sectors.

Features

Unlock the power of multifamily data

Get unparalleled insights into multifamily properties, helping you identify investment opportunities and track market trends. With comprehensive property-level details, including ownership, rents and occupancy, our platform allows you to evaluate investment potential and optimize asset management.

Gain transparency into affordable housing

Accessing essential data for fully affordable multifamily investments has never been easier. Say goodbye to time-consuming research and limited availability of records. Search properties by primary and secondary affordability type, AMI% splits and compliance periods.

Stay current on SFR/BTR essentials

Capture and execute single-family rentals and build-to-rent business with real-time data that drives profitable investment prospecting, preliminary underwriting and asset management. Join the inside track of this dynamic sector with continuously expanding coverage of hundreds of thousands of SFR units in thousands of BTR communities. Refine your strategy with monthly updates on rental rates, the supply pipeline, rent growth, occupancy and more.

Optimize your student housing strategy

Equip yourself with tools that provide an understanding of leasing patterns and market dynamics to make data-driven decisions.

- Understand demand trends: Leverage demographic and enrollment data to adjust your leasing strategy.

- Access comprehensive data: Stay ahead of rent trends, vacancy rates and lease terms.

- Evaluate market conditions: Make informed decisions on new developments, acquisitions and investment strategies based on the most current data.

Drive efficiency & growth in self storage

Having the right data is key to seizing new opportunities. Get detailed, accurate data that includes:

- Competitive insights: Compare your property performance against competitors using real-time rent, occupancy and pricing data.

- Uncover opportunities: Identify emerging markets and optimize your portfolio with insights on supply and demand trends.

- Operational efficiency: Get facility size, unit types and amenities data to boost occupancy rates and optimize pricing.

Make confident office real estate decisions

Staying ahead of a rapidly evolving market means having access to the right data:

- Evaluate lease terms and tenancy: Gain insight into lease expiration dates, rent escalation clauses and tenant quality across office buildings.

- Track space utilization trends: Understand the shift toward hybrid work environments and its impact on office demand and leasing strategies.

- Discover investment opportunities: Leverage the latest market data to uncover high-yield office properties and emerging markets.

Gain a competitive advantage in industrial real estate

Industrial real estate needs data that provides clarity and helps drive success:

- View supply and demand trends: Track development pipelines, vacancy rates and rent changes to help you predict market shifts.

- Locate high-demand locations: Find the best locations for logistics and distribution with real-time data.

- Optimize property acquisition: Access property ownership, leasing activity data and regional market performance to guide your investment strategy.

Explore vacant land opportunities

Access market insights, detailed property data and advanced analytics to make informed, profitable decisions.

- Comprehensive market data: Get up-to-date, accurate data on sales, trends and property values to identify opportunities.

- Targeted search and filtering: Utilize customizable search tools based on location, price, zoning and other critical factors.

- Detailed property analytics: Leverage reporting tools to assess the potential return on investment (ROI), to make data-driven decisions with confidence.

Resources

FAQ

Yardi Matrix offers comprehensive market intelligence across various property types: multifamilyn (which includes affordable housing, student housing and single-family rentals in build-to-rent communities), office, industrial, self-storage and vacant land.

The platform provides full ownership and management details for properties including LLC transparency and senior-level contacts.

Yes, users can discover projects in the development pipeline within specific markets or surrounding areas, evaluating the demand/supply balance to make informed development decisions.

In addition to full ownership details, the platform enables proactive searching for potential deals by providing information such as loan maturities, rent, occupancy and sales histories, which are crucial for preliminary underwriting.

It offers data on in-place loans and expirations, including construction, permanent and CMBS loans, which is valuable for lenders and financial analysts monitoring loan portfolios.

Yes, users can discover projects in all stages of the development pipeline within specific markets or surrounding areas.

Yardi Matrix provides short- and long-range forecasts of rent and occupancy at both market and sub-market levels.

Yes. Matrix provides the unique ability to look at an aggregate comparison set for actual revenue and expense benchmarking, accessible at the comparable set, market or submarket levels.

ENERGIZED FOR TOMORROW

We’re here to help

Do more with innovative property management software and services for any size business, in every real estate market.